Stocks kicked off December on a sour note, pulling some of November’s best performers lower.

Last month’s hot stocks, including Autodesk, Adobe, Target, Disney and Capri, were all under pressure at the start of the new month.

One top-performing chipmaker could be among those susceptible to further weakness in the near term, according to Katie Stockton, founder of Fairlead Strategies.

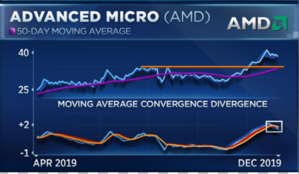

“AMD [cleared] its summertime highs and also long-term resistance from prior to that. The breakout saw great follow-through, ran up about 12% in November, and of course now there’s room to [fall to] support based on that breakout point, which was roughly $34 to $35,” Stockton told CNBC’s “Trading Nation” on Monday.

AMD would need to fall 12% to get back down to $34. The stock has not broken below that level since late October.

“A pullback to that support level would actually be welcome from a technical perspective and that would increase the risk-reward ratio following that breakout so I do think some of these stocks that have run up following breakouts are prone to pullbacks, more so than the broader market or major indices, but I would see them as opportunities to add exposure,” said Stockton.

Mark Tepper, president at Strategic Wealth Partners, agrees that AMD is prime for a pullback.

“The stock is up over 100% this year, trading at a forward [price-to-earnings ratio] of about 36, so it’s not cheap. And they’ve been doing a great job taking market share from Intel, but … expectations are high,” Tepper said during the same segment. “We should know by December 15 how this stock is going to end up for the year. If the trade war reescalates, all semis are going to take it on the chin, especially AMD which is a high beta semi.”

There is one other name Tepper sees as at risk of a pullback after a massive run — Autodesk. The software stock has rallied 19% in the quarter.

“It’s trading in a really high multiple because sentiment generally has been pretty positive, but it’s also a stock that’s highly correlated to architecture and construction, so if those things start to look ugly, or the global economy looks to be weakening, the multiple is going to pull back,” Tepper said.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates