“The lower shipments suggest that Apple’s Greater China revenues should be at the very least a significant drag on our overall estimate of 18 percent iPhone revenue growth in the second fiscal quarter,” Kvaal added.

His earnings per share estimate for Apple’s second fiscal quarter of $2.69 is below the consensus estimate of $2.71, according to FactSet data. He sees EPS of $2.12 in the third quarter, below expectations of $2.19.

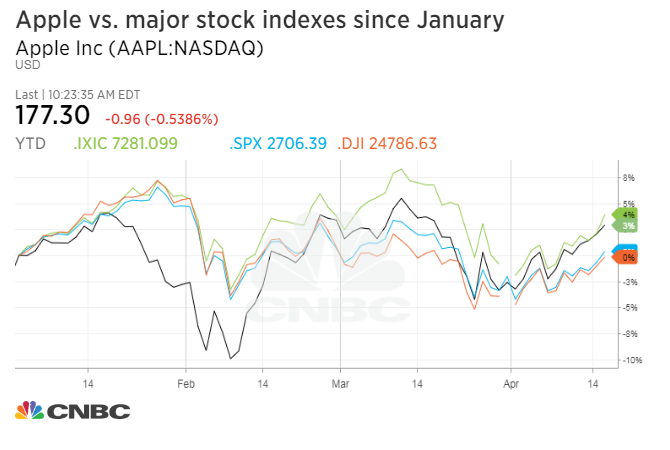

Shares of Apple fell 0.1 percent Wednesday following the analyst’s note. The company is expected to report earnings May 1 after the bell.

As the world’s largest company, Apple’s recently soft iPhone sales have given Wall Street pause, especially because unit sales comprise such a large portion of its revenues.

Goldman Sachs, for example, initiated coverage for Apple with a neutral rating in February due to its expectations that the smartphone maker will miss sales targets for the June quarter.

“We balance our positive view on longer-term iPhone revenue growth … with weakening near-term datapoints on iPhone X demand, which we think will likely weigh on shares ahead of the second fiscal quarter’s earnings report,” Goldman analyst Rod Hall wrote at the time.

Still, some are optimistic that Apple’s plan to return a large amount of capital to shareholders could spur shares higher. How Apple will deploy its capital remains unclear, with options ranging from a dividend or buyback to a new acquisition.

For his part, Kvaal believes it unlikely Apple will make a big acquisition, citing its history of avoiding large-scale buyouts.

“Apple has traditionally been conservative in acquiring large companies. Its largest acquisition to date has been Beats for $3 billion,” he explained. He suggested that it could, instead, dedicate roughly $25 billion for dividends over the next five years, leaving an additional $135 billion left for share repurchases.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates