The Dow closed Thursday down 2.8 percent, or 660.02 points, at 22,686.22.

“You look at things like the new orders data, which has been trending lower not just in the U.S. but globally. That is reflecting weaker growth expectations by manufacturers in the U.S. and part of those are attributed to trade policy tensions,” said Gapen.

Economist said the tightening of financial conditions from a falling stock market could be a factor in the ISM. “That could be part of it but the stock market is also going down due to concerns about global growth, profitability, protectionism. I don’t think you can separate those things out,” Gapen said.

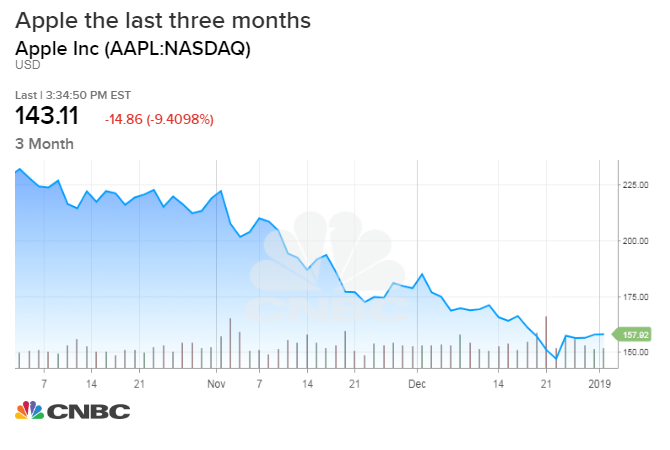

In an unusual warning Wednesday, Apple said its fiscal first-quarter revenue would be $84 billion, down from the $89 to $93 billion it previously expected. It blamed the shortfall on a weaker Chinese economy and lower-than-expected iPhone revenue, “primarily in Greater China.” Apple also blamed upgrades to new iPhone model in other countries that were not as strong as expected.

Clifton said what investors are trying to discern now is how much of Apple’s problems are the Chinese economy, the iPhone upgrade cycle and how much is a possible boycott of U.S. goods.

“There may be some consumer backlash to American companies, a form of nationalism,” said Bernstein analyst Toni Sacconaghi. But he said there are many things at work with iPhone sales, including a weaker upgrade cycle and the macro picture of a weaker China.

The U.S. has been cracking down on Chinese telecom companies ZTE and Huawei for suspected cyber espionage, and could still extradite Huawei’s CFO who is under arrest in Canada.

Clifton said he expects to see other companies follow Apple, now that it has given them “cover” to blame China’s economy. Some companies have already pointed to China, while others, like Nike have not seen an impact. But Tiffany, for one, said its sales were impacted by softer spending from Chinese tourists in Hong Kong and New York.

According to Coresight Research, China’s retail sales grew 8.1 percent in November, the slowest pace in 15 years. Some economists said the ISM data also reflects the decline in the stock market, denting confidence and causing manufacturers to pull back. But some is also trade, as reflected in comments by companies in the survey.

“The perception is at least a portion of that is going to be due to trade,” said Clifton. “There’s no fighting the narrative itself. That’s why I think it could accelerate the progress that’s being made in these talks. I think they’re much further along than anyone anticipates. I think the process has been going on for a year. They understand they were going to have a deal on Dec. 1, and the market didn’t believe it.”

Trade negotiators meet next week. The administration, including Trump, has sounded optimistic on a deal lately.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates