Beyond Meat CEO Ethan Brown speaks before ringing the opening bell at Nasdaq MarketSite, May 2, 2019 in New York City.

Drew Angerer | Getty Images

Volatility could be returning to Beyond Meat.

Shares of the maker of meat substitutes were recently trading up nearly 12% at just under $155 on Thursday after McDonald’s announced a test of the company’s plant-based burgers in Canada. The announcement did little to move McDonald’s shares, which have a market value of nearly $165 billion, but Beyond stock hit an intraday high above $160. Its market value is just over $9 billion.

Since its initial public offering in May, Beyond shares have surged 506%. The stock climbed to an all-time high of $239.71 per share in late July ahead of its quarterly earnings report. But when the company announced a secondary share offering along with its earnings, the stock took a dive and has not traded above $200 per share since then.

.1569512690265.png)

Still, in August and September, the stock has experienced lower volatility, although it continues to fluctuate.

Trader and CNBC contributor Jon Najarian said that it is unclear if the secondary offering resulted in fewer wild swings for the stock. Instead, he attributed the stock’s relative stability to more long-term deals with restaurants.

“The more you get stabilization in the orders, the more people will no longer just dismiss it as a flash in the pan,” he said.

For example, Dunkin’ started offering Beyond’s plant-based sausage in New York City in July and plans to release it nationwide in the future.

However, a test in 28 stores in Canada does not ensure that McDonald’s will pursue a larger roll-out with Beyond in the future. Tim Hortons, the Canadian coffee chain owned by Restaurant Brands International, recently pulled Beyond’s sausages and burgers from locations in all provinces except British Columbia and Ontario after a limited-time offer expired.

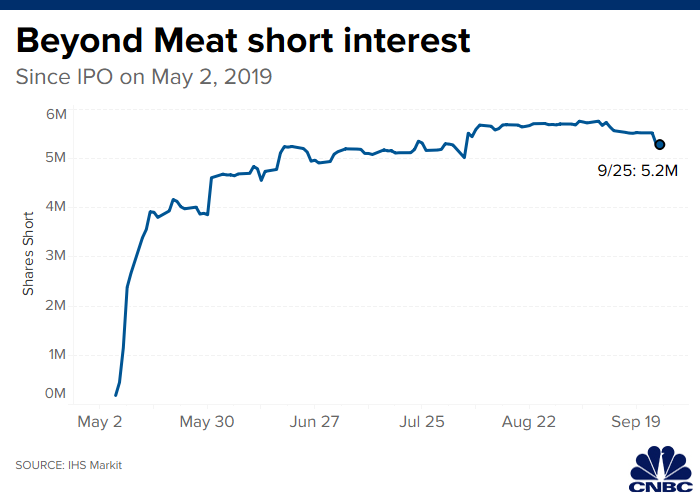

Short interest

Since Beyond’s blockbuster market debut, short sellers have targeted the stock in the hopes that they can cash in if the shares drop dramatically. To short a stock, an investor borrows shares with the expectation that its price will fall and the investor can repurchase it at a profit.

More than 41% of Beyond’s outstanding shares are being shorted, according to data from S3 Partners.

Najarian said that short sellers will become more interested in the stock as it inches closer to $200 per share, which could mean higher volatility.

“Anyone watching charts will take a look at that,” he said. “Lots of short covering to get it through that level.”

Short sellers looking to cover their losses by purchasing the same number of shares they are shorting can push the stock price even higher. This unintended effect happens to stocks — like that of Beyond — with a high amount of short interest.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates