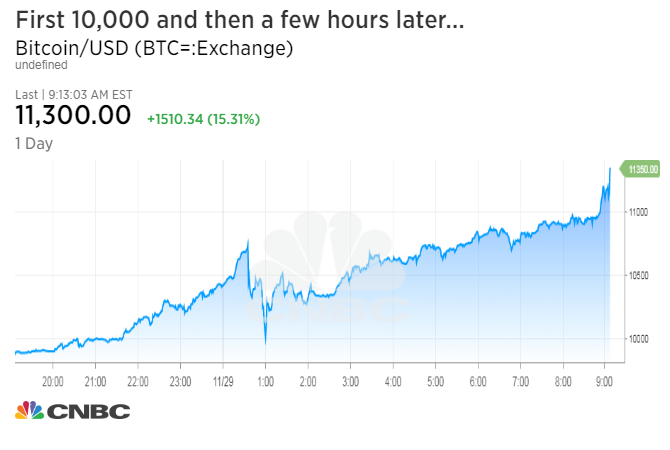

The Bitcoin rally is accelerating.

The digital currency spiked through $11,000 Wednesday morning, hours after surpassing the $10,000 level for the first time. Bitcoin traded at an all-time high of $11,155.20 at around 9:00 a.m. ET, according to industry site CoinDesk. By 9:16 a.m., bitcoin had leaped all the way to $11,377.33, according to CoinDesk.

Much of that incredible gain came just about 12 hours after the cryptocurrency smashed through the $10,000 mark that many analysts had been hyping for months. But few saw it happening this quickly.

All told, it’s been an exponential ascent from 6 cents seven years ago and less than $1,000 at the start of this year.

Bitcoin jumped above $9,000 over the weekend — just about a week after topping $8,000 — as about 300,000 users joined Coinbase, the leading U.S. platform for buying and selling bitcoin, around the Thanksgiving holiday, according to data compiled by Alistair Milne, co-founder and chief investment officer of Altana Digital Currency Fund.

Coinbase’s GDAX exchange said in a status alert email Wednesday at 9:46 a.m. that “GDAX is experiencing intermittent login issues. Our team is investigating.”

Separately, the world’s largest bitcoin exchange, bitFlyer, announced Tuesday it is launching in the U.S.

U.S. dollar-bitcoin trading volume only made up about 21 percent of the total Wednesday, according to CryptoCompare. Japanese yen trading in bitcoin dominates at about 64 percent, while trading in South Korean won accounts for about 8 percent, according to CryptoCompare.

Digital currency ethereum also hit a record high Wednesday of $519.85, according to CoinMarketCap. The bitcoin offshoot, bitcoin cash, traded slightly higher near $1,619.36, well off its record high, according to CoinMarketCap.

“Parabolic rallies are inherently unsustainable, otherwise bitcoin’s value would surpass all the wealth of the world within a few years,” Ari Paul, CIO and managing partner at cryptocurrency investment firm BlockTower Capital, said in an email to CNBC. “But…while the pace of the rally is unsustainable and there will inevitably be corrections and crashes over time, it remains ‘cheap.'”

Since bitcoin’s market capitalization is less than $200 billion, enthusiasts point out the digital currency could rise dramatically if it draws even a tiny fraction of the world’s $200 trillion in traditional financial market assets.

More than 120 “cryptofunds” have launched, including some run by Wall Street veterans, according to financial research firm Autonomous Next. In another move towards establishing bitcoin’s legitimacy as an asset class, the world’s largest futures exchange, CME, is planning to launch bitcoin futures in the second week of December.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates