Blame the stock market’s rally for the bitcoin craze that has swept financial markets these last few weeks.

While debate rages over whether the digital currency is in a bubble, several market analysts say the cryptocurrency hype would not be possible unless financial markets overall were in the late stage of a bull market or nearing the end of their latest run higher.

“I see bitcoin as something that’s really, really coincident with what’s happening in stocks, bonds, real estate and the art world,” Elliott Prechter of The Elliott Wave Theorist newsletter, told CNBC in a phone interview. “The crypto bubble is not happening in a bubble.”

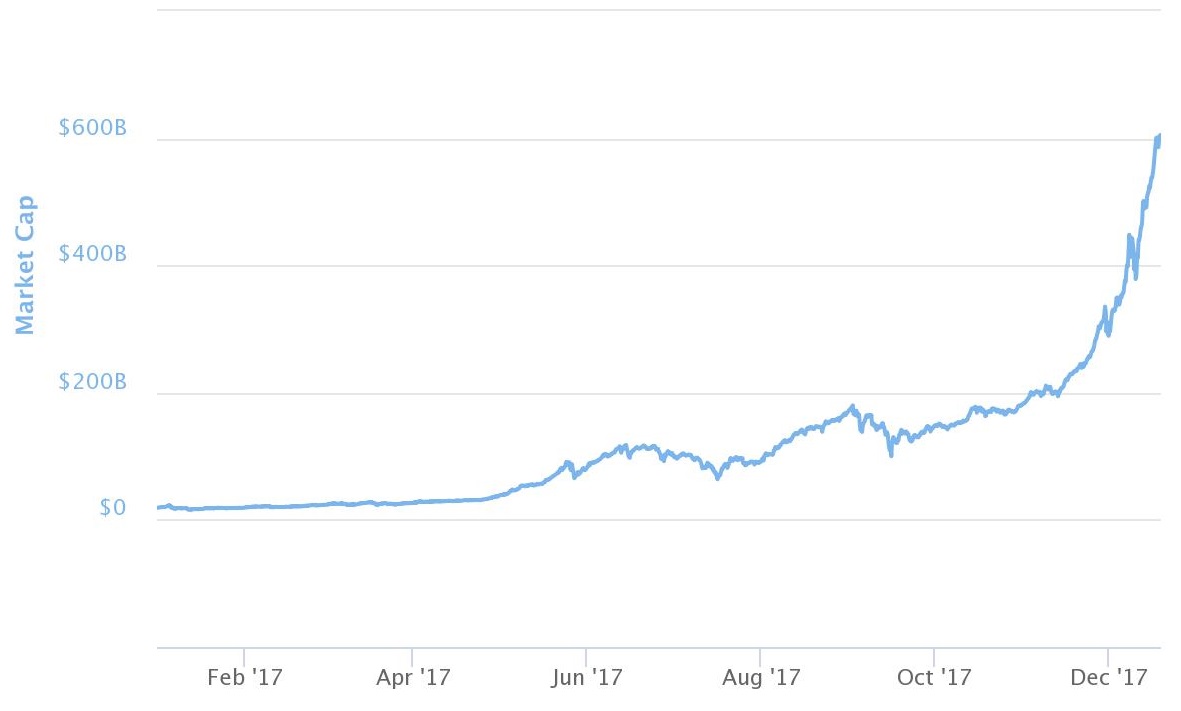

Bitcoin has surged 2,000 percent over the last 12 months to briefly more than $19,000 per coin, according to Coinbase, the leading U.S. platform for buying and selling major digital currencies. The total market value of more than 1,300 digital coins that exist today has multiplied more than 30 times this year to $600 billion, according to CoinMarketCap.

Prechter forecast bitcoin’s surge when the digital currency was just 6 cents in 2010. He’s the son of the famed technical analyst Robert Prechter, who popularized the widely followed Elliott Wave theory by using it to forecast the stock market crash of 1987. Although debate over the accuracy of the Elliott Wave has grown, its analysis of cycles of sentiment appears quite relevant for excitement around bitcoin.

The theory holds that five waves typically signal a coming downturn, and Prechter maintains that bitcoin is riding a fifth-wave “blow off phase” that will likely be followed by a drop to $150 a coin. “It’s very rare to find this kind of speculative activity during a bear [market or] recession,” he said.

Growth in market value of all cryptocurrencies

Source: CoinMarketCap

Prices are climbing rapidly in other markets.

On Nov. 15, auction house Christie’s said it had sold the most expensive painting ever, Leonardo da Vinci’s “Salvatore Mundi,” for $450 million.

The S&P 500 has soared 20 percent this year to all-time highs in the second-longest bull market on record, meaning a period without any 20 percent drops from a recent high. The Dow Jones industrial average has also added 5,000 points in just one year for the first time ever.

“Cryptocurrency mania was only achievable at an extreme in confidence,” Peter Atwater, an investor sentiment expert and president of Financial Insyghts, wrote in a Friday commentary.

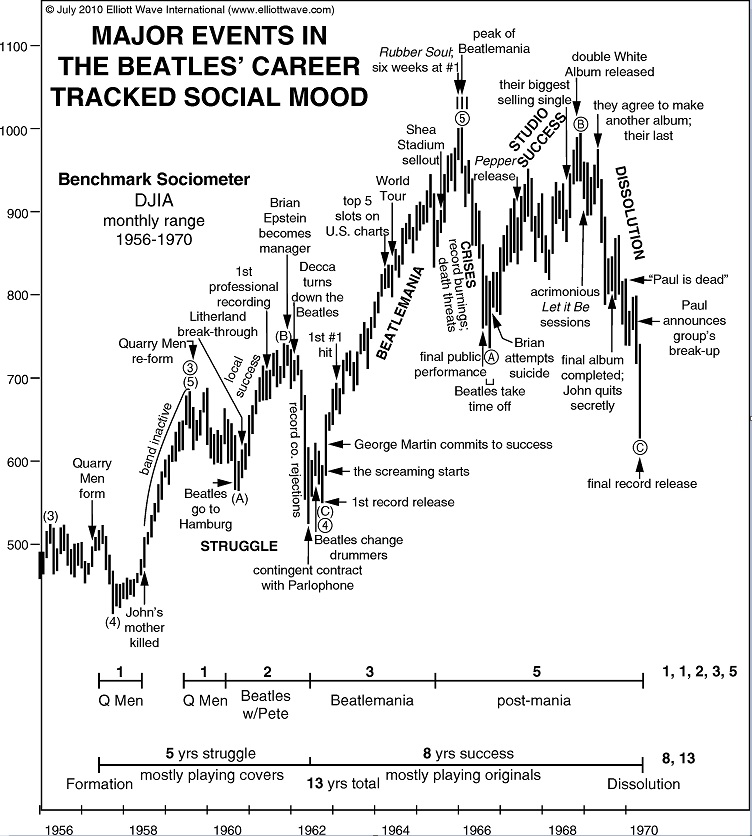

“Folks forget that the Beanie Baby bubble was coincident with the end of the dot.com bubble and Beatlemania marked the end of the 30+ year bull market that began at the bottom of the Great Depression,” he said. “Manias are manias are manias — and they all come out to play at the same time — THE top!”

Monthly range of the Dow Jones industrial average around Beatlemania

Source: Socionomics Institute, Elliott Wave International

The hype around bitcoin has spread rapidly to other digital currencies, all of which had a fairly narrow following just a few months ago. CNBC analysis of global Twitter mentions gathered by Spredfast found that discussion of ethereum and litecoin has exploded more than 1,000 percent from January to November. Ripple mentions are up more than 1,800 percent, while bitcoin mentions grew just over 300 percent, the data showed.

More significantly, interest in the cryptocurrencies has climbed in middle America, away from the finance and tech hubs most involved with developing them.

Ohio-based Twitter mentions of the four digital currencies grew 890 percent from January to November, and Texas-based mentions climbed nearly 670 percent. Illinois was the fastest-growing state at 1,048 percent, likely because Chicago’s two leading derivatives exchanges launched bitcoin futures this month.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates