President Donald Trump meets with China’s President Xi Jinping at the start of their bilateral meeting at the G20 leaders summit in Osaka, Japan, June 29, 2019.

Kevin Lemarque | Reuters

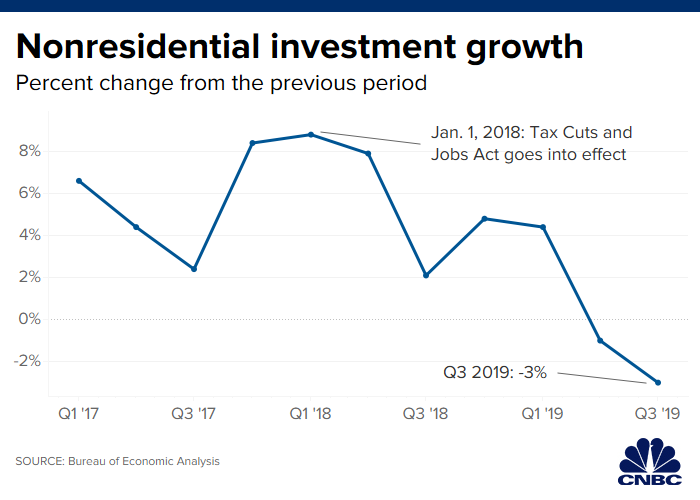

President Donald Trump’s tax cuts may not have had the stimulating effect he promised, according to government data released Wednesday.

Business investment for the third quarter dropped 3%, after falling 1% in the previous quarter. Those drops mark a contrast to jumps of 4.4% in the first quarter and 4.8% in the fourth quarter of 2018.

The decline comes amid economic uncertainty, spurred in part by Trump’s trade war with China. It casts uncertainty on his contention that the $1.5 trillion tax bill he signed in December 2017 would be a boon for business investment, hiring and wage growth.

“Corporations are literally going wild,” he said at the time.

There are other signs that uncertainty may be creeping into the board room. Global deal-making, often a sign of CEO confidence, fell in the third quarter, with total deal value dropping 21.2% to $622 billion from $790 billion, according to Mergermarket. In the U.S., the value of deals dropped 32%, to $263 billion from $387 billion.

To be sure, both trends could reverse themselves. Uncertainty regarding trade may be diminishing, with the Office of the U.S. Trade Representative saying last week that China and the U.S. are close to finalizing a phase one deal.

And other data released on Wednesday was more optimistic. A monthly survey by ADP and Moody’s Analytics found that companies hired 25,000 more employees in October than expected by economists polled by Dow Jones. Growth of the U.S. gross domestic product also topped expectations of economists, despite the drop in business investment.

Still, as the 2020 election heats up, the numbers give Trump’s opponents material to lambast his policies. An economic policy advisor for Sen. Elizabeth Warren tweeted on Wednesday, “To really boost business investment and the economy, put money in people’s pockets to spend. That’s what the @ewarren economic agenda is all about.”

Warren’s wide-ranging economic agenda rests in part on the premise that too much U.S. wealth is isolated among select companies and wealthy individuals. Her plans include an “ultra-millionaire” tax, which calls for a 2% tax on every dollar a household has above $50 million and a 3% tax on households with above $1 billion. She wants to tax companies 7% for every dollar they make above $100 million.

Her agenda, though, appears to rattle CEOs in a different way. Wall Street’s stock analysts have identified shares of companies in health care, financials and energy as vulnerable in the event of her election. Share prices of many of them, including United Health and Apollo Global, have already dipped on apparent concern over her proposed policies.

Correction: The decline in business investment in the second quarter was 1%, and the 4.8% gain in 2018 was for the fourth quarter of that year.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates