Deutsche Bank has told clients that Caterpillar is likely to see an uptick in revenue and share price as mining and oil companies look to renew aging equipment.

Resuming coverage on the Deerfield, Illinois-based company with a buy rating, analyst Chad Dillard said the machinery manufacturer still has years of strong income ahead.

“Caterpillar is earlier in its cycle than the market gives credit and our preferred way to play the early stage equipment replacement cycle,” Dillard said in a note Tuesday. “Mining and oil & gas producers have systematically underinvested in equipment and are in the early stages of replacing the equipment bought during the height of the commodity super cycle.”

Dillard estimates the results could be so good that mining and oil and gas sales could grow at 30 percent and 10 percent, respectively, each year for the next few years.

Caterpillar should also be more insulated than peers from any softness in the U.S. construction industry, with only 20 percent of income coming from equipment sales in the sector, the analyst added.

On a valuation basis, Dillard said Caterpillar trades at a 45 percent discount to the S&P 500, its largest discount in almost 20 years.

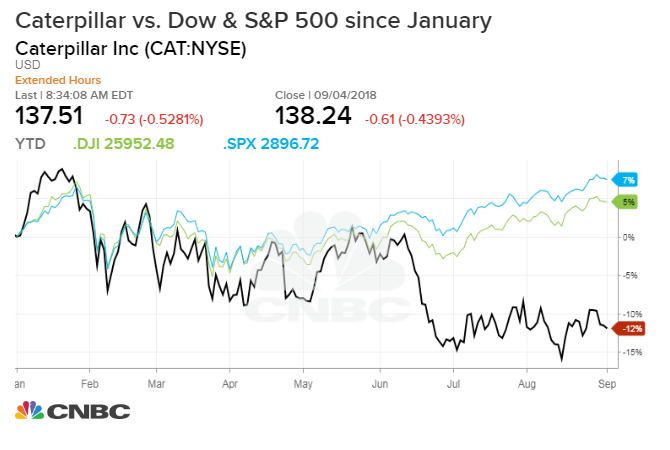

Despite the several bullish calls on Wall Street, the Dow Jones Industrial Average component has underperformed both the blue-chip index and the S&P 500 in 2018, down more than 12 percent since January.

Shares rose 1 percent Wednesday.

Its year-to-date decline makes it the worst performer in the Dow this year, beating out fellow conglomerates 3M and Procter & Gamble, which are down 11.3 percent and 9.99 percent, respectively.

The Trump administration’s prolonged trade war and rising costs due to tariffs is likely weighing on investor sentiment.

Though the company reported record second-quarter profit per share in its most recent financial update, it added that it expects an increase of $100 million to $200 million in its material costs in the second half of the year. Caterpillar said it plans to offset the rising costs with price hikes of its own.

The revelation came just after the U.S. slapped tariffs on $34 billion of Chinese goods in July. The U.S. also implemented tariffs on steel and aluminum imports from Mexico, Canada and the European Union.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates