Traders work on the floor of the New York Stock Exchange.

Brendan McDermid | Reuters

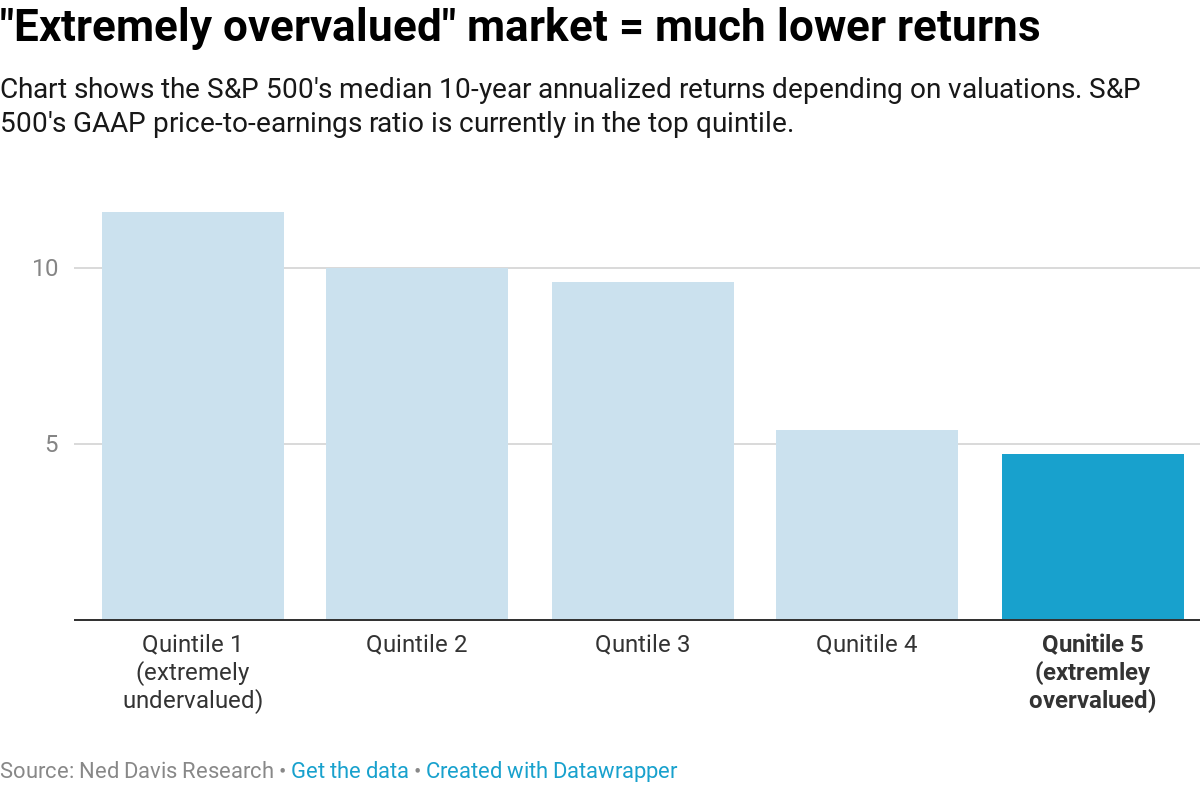

Stocks recently notched all-time highs and with the Federal Reserve likely cutting rates later this month, the rally could keep going. But buying stocks when they are this expensive has historically led to lower future returns, data compiled by Ned Davis Research shows.

The S&P 500’s price-to-earnings ratio — one of the most widely used valuation metrics — is sitting at 21.5 on a GAAP basis, well within its historical top quintile. The index’s median return over a 10-year period when valuations are so high is 4.7%, when adjusted for inflation. The S&P 500’s median returns when valuations are at lower quintiles range between 5.4% and 11.6%, according to Ned Davis Research.

The market’s historically high valuation comes at a time when many investors are expecting easier Fed policy to further juice gains in 2019. It also comes at a time when stocks are historically cheap relative to bonds. Lower rates make stocks more attractive relative to bonds as it becomes harder to find yield in the bond market.

But with the S&P 500’s absolute valuation being so high, investors should be more cautious moving forward, Ned Davis notes.

“Absolute valuations have done a better job than relative ones of identifying stocks as cheap or expensive in the long run,” Ed Clissold, chief U.S. strategist at Ned Davis Research Group, wrote in a note.

The S&P 500 is up around 20% in 2019 in part because the Fed has pivoted away from its initial stance on rate hikes. Entering 2019, the Fed had forecast it would raise rates twice this year. Since then, the Fed brought down its rate-hike forecast to zero and has increased expectations for lower rates as soon as July.

Fed Chair Jerome Powell reaffirmed those expectations last week. In his testimony to Congress, Powell said “crosscurrents ” stemming from slower economic growth and lingering U.S.-China trade tensions were dampening the U.S.’ outlook on the economy.

Stocks and bonds have rallied side by side as a Fed rate cut becomes more likely. The benchmark 10-year Treasury note yield has fallen nearly 60 basis points in the past six months (yields move inversely to prices). The S&P 500 is up more than 14% in that time.

After such a strong gain, “few would be surprised to see that stocks are expensive,” Clissold said. But “if stocks are so expensive, should investors put their money elsewhere? Central banks have left few options in the fixed income asset class.”

“For that reason, relative valuations provide a starkly different picture than absolute ones,” he added. “Comparing the S&P 500 GAAP earnings yield (inverse of the P/E ratio) to the 10-year Treasury yield, stocks are in the cheapest quintile versus T-notes historically.”

But the strategist points out that one of the key reasons stocks are so cheap relative to bonds is because of the sharp plunge in yields. “With the Fed poised to cut rates on July 31, the prospect for higher rates in the short term is dim, but history cautions against just relying on stocks being less overvalued than bonds.”

Subscribe to CNBC on YouTube.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates