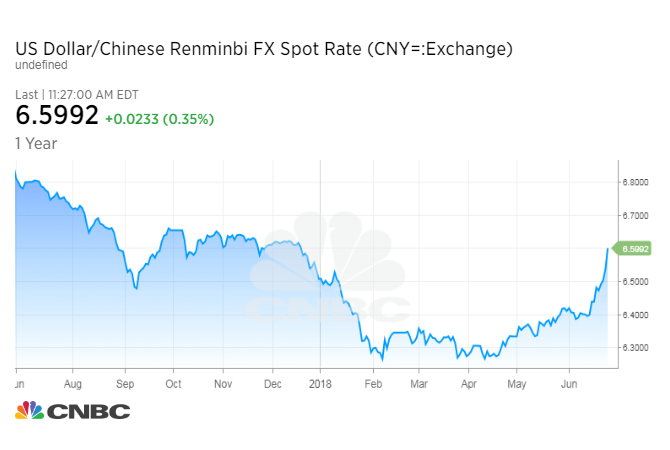

China’s currency slid to a fresh six-month low against the dollar Wednesday, sparking speculation China could use a weakened yuan as a weapon if tensions with the U.S. turn into an out-and-out trade war.

The idea is that China could let the yuan fall, making Chinese goods cheaper on the world market as a result. However, analysts doubt that China would do that intentionally, and the chatter for now is just talk, they say.

“It appears to be a soft devaluation at this point. It created a lot of ruckus this morning, and markets were very, very on edge,” said Boris Schlossberg of BK Asset Management. “The Trump announcement today that he’s going to dial back his trade rhetoric has put a ceiling on the move for the time being.”

Some of that anxiety in the currency market lifted after President Donald Trump Wednesday said he would back an overhaul of the existing Committee on Foreign Investment in the United States, or CFIUS, and that committee would determine whether Chinese companies should be allowed to take ownership in U.S. companies. That was seen as a pullback from harsher measures that could have been imposed, such as blocking companies with 25 percent Chinese ownership from buying certain tech-related companies.

Traders have been watching the currency fall against the greenback since trade rhetoric picked upearlier this month. The dollar hit a high of 6.6145 against the yuan, its highest level since Dec. 19, but it fell back slightly after the CFIUS news.

“The key thing now is, was today the turning point in all the trade wars rhetoric? Are we going to get a lot more constructive in our policy discussions or is it simply until we re-engage? It appears the Trump administration is backing off its most aggressive stance,” said Schlossberg.

“It’s not over yet,” he said, but he did note that the yuan hit a key resistance level.

China has often been accused in the past by the U.S. government of intentionally keeping its currency depressed to help its exporters. The Trump administration this year stopped short of officially calling China a “currency manipulator,” and China’s currency has actually been fairly steady for most of the year.

Analysts say China is far from intentionally devaluing its currency, though it may be using less influence to keep it from sinking.

Deutsche Bank currency strategist Alan Ruskin said it’s not clear if the decline is over. “Let’s see how it trades over the next 24 hours,” he said.

Ruskin said the market talk about currency wars is so far unfounded. “I don’t think it behooves anybody’s interest to open that front. A trade war in theory, if it turns ugly, could spark a currency war, but I don’t think that’s where any of the parties want to go to at this point,” Ruskin said.

He also added that easier Chinese monetary policy could have helped fuel the decline. “The Chinese have just recently cut their reserve requirement, which is effectively an easing. There’s important divergences that are going on, independent of the trade story,” he said.

Robert Sinche, global strategist with Amherst Pierpont, said while China has not weakened its currency, which is also called the renminbi, it may no longer be slowing a decline.

“It looked like they were impeding the dollar’s rise against the renminbi, in line with what you normally expect given the general strength of the dollar. That caught up last week,” he said. “They weren’t letting the currency weaken as much as it should have, so the trade-weighted renminbi was actually rising in that environment. I think they might have said, ‘The U.S. is not going to play nice, we’ll let the renminbi trade as it should.’”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates