Foot Locker Inc. signage is displayed in the window of a store in New York, U.S.

Michael Nagle | Bloomberg | Getty Images

Here are the most important things to know about Friday before you hit the door.

1. Healthy consumer?

We’ll get a read on the health of the consumer on Friday with November’s final consumer sentiment data set to release at 10:00 a.m. Sentiment in the U.S. in October came in at 95.5, according to data released by the University of Michigan. A higher reading means consumers feel more confident about current and future economic conditions.

Economists polled by Dow Jones are expecting sentiment to come in at 95.5, in line with last month’s data and slightly below the preliminary reading of 95.7.

2. Manufacturing and services gauge

We’ll get a read on the U.S. manufacturing and services sector with PMIs from Markit released on Friday. Economists polled by Dow Jones are expecting a slightly stronger reading of manufacturing activity in November at 51.4, compared with 51.3 in October.

While the PMI Markit data didn’t show contraction last month, the closely watched manufacturing purchasing managers’ index from the Institute for Supply Management came in at 48.3 in October. A number below 50 represents a contraction in the industry.

Services PMI is forecast to come in at 51, up from the previous reading of 50.6, according to Dow Jones.

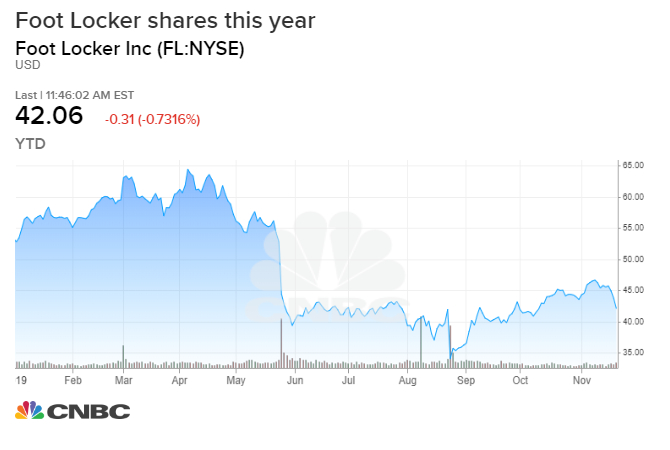

3. Foot Locker earnings

Shoe company Foot Locker reports third quarter earnings before the bell on Friday. Bank of America Merrill Lynch is expecting earnings per share of $1.08 and same-store sales growth of 6%. In the same period last year, Foot Locker reported earnings of 95 cents per share and same-store sales growth of 2.9%.

Bank of America expects strong same-store sales to be driven by favorable launch calendars for the Jordan Retro brand, Yeezy and Air Jordan 1s and Air Force 1s. But the firm continues to see long-term challenges for Foot Locker due to its shift to digital, increased competition from sporting goods retailers and “pressure from the brands themselves as they continue to steer customers to their own Direct-to-Consumer websites,” said Bank of America research analyst Robert Ohmes in a note to clients.

Shares of Foot Locker are down more than 20% this year.

The S&P 500 is down about 0.5% for the week heading into Friday.

Major events (all times ET):

9:45 a.m. Manufacturing PMI

9:45 a.m. Services PMI

10:00 a.m. Consumer sentiment

11:00 a.m. KC Fed survey

Major earnings:

Foot Locker (before the bell)

JM Smucker (before the bell)

—with reporting from CNBC’s Michael Bloom.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates