Netflix shares were downgraded by Deutsche Bank from “buy” to “hold’ on Tuesday, following the streaming company’s huge second quarter subscriber miss on Monday.

“The slowdown in growth is not thesis changing, but does require a re-evaluation of value and consideration of the stock’s year to date appreciation from $200 per share,” Deutsche Bank said in a note to investors. “Our long-term outlook for Netflix’s business has not changed all that much.”

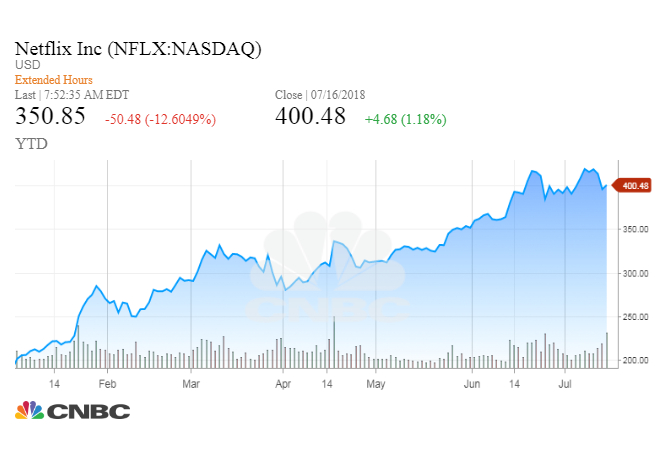

Netflix stock is down nearly 13 percent in premarket at $349 per share. The company’s stock had risen more than 108 percent this year, at $400.48 per share at the close of trading Monday.

Netflix missed its quarterly subscriber addition projections by a staggering 1 million subscribers. The company had pegged that quarterly number at 6.2 million but only reported 5.15 million subscribers, overturning its own reputation for beating estimates.

Netflix missed its quarterly subscriber addition projections by a staggering 1 million subscribers. The company had pegged that quarterly number at 6.2 million but only reported 5.15 million subscribers, overturning its own reputation for beating estimates.

Deutsche Bank lowered its price target on the company’s shares to $350, from $360.

“Despite continuing to like the story, we just don’t see much upside over the next 12 months at this valuation level,” the firm said, before adding that it still thinks Netflix “stock can double by 2025, to $700” per share.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates