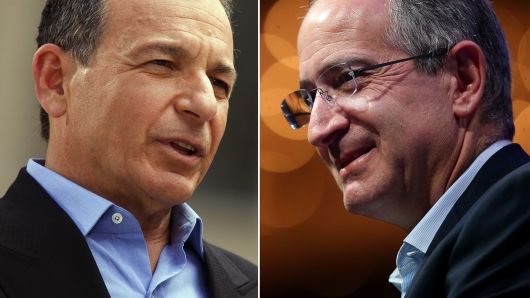

Getty Images

Robert Iger, chairman and chief executive officer of Walt Disney Co. and Brian Roberts, Comcast chairman and CEO.

The biggest media companies still want to eat, but first, they’re going to need a break to digest.

Comcast, Disney and AT&T have all made their giant media acquisition plans this year, culminating in Comcast’s auction win for U.K. pay-TV provider Sky.

AT&T is spending $85 billion to acquire Time Warner (pending the Department of Justice’s regulatory appeal), Disney forked over $71 billion to buy the majority of 21st Century Fox and Comcast is placing a $39 billion bet on Sky.

That’s a lot of money, followed by a lot of integration, for three of the largest U.S. media companies.

It leaves some of the smaller media companies — CBS, Viacom, Lions Gate, MGM, AMC Networks and Discovery Communications — out in the cold if they’re interested in selling. At least for the time being.

That may push some of the smaller media companies — the “free radicals,” as media mogul and Liberty Media Chairman John Malone likes to call them — together with each other, if they don’t want to wait. CBS and Viacom, for example, are still likely to merge, despite several false starts, according to BTIG analyst Rich Greenfield. Sirius XM, whose controlling shareholder is Malone’s Liberty, picked off Pandora for $3.5 billion in a deal announced Monday.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates