U.S. equities sank on Tuesday after President Donald Trump suggested he may want to delay a trade deal with China until after the 2020 presidential election.

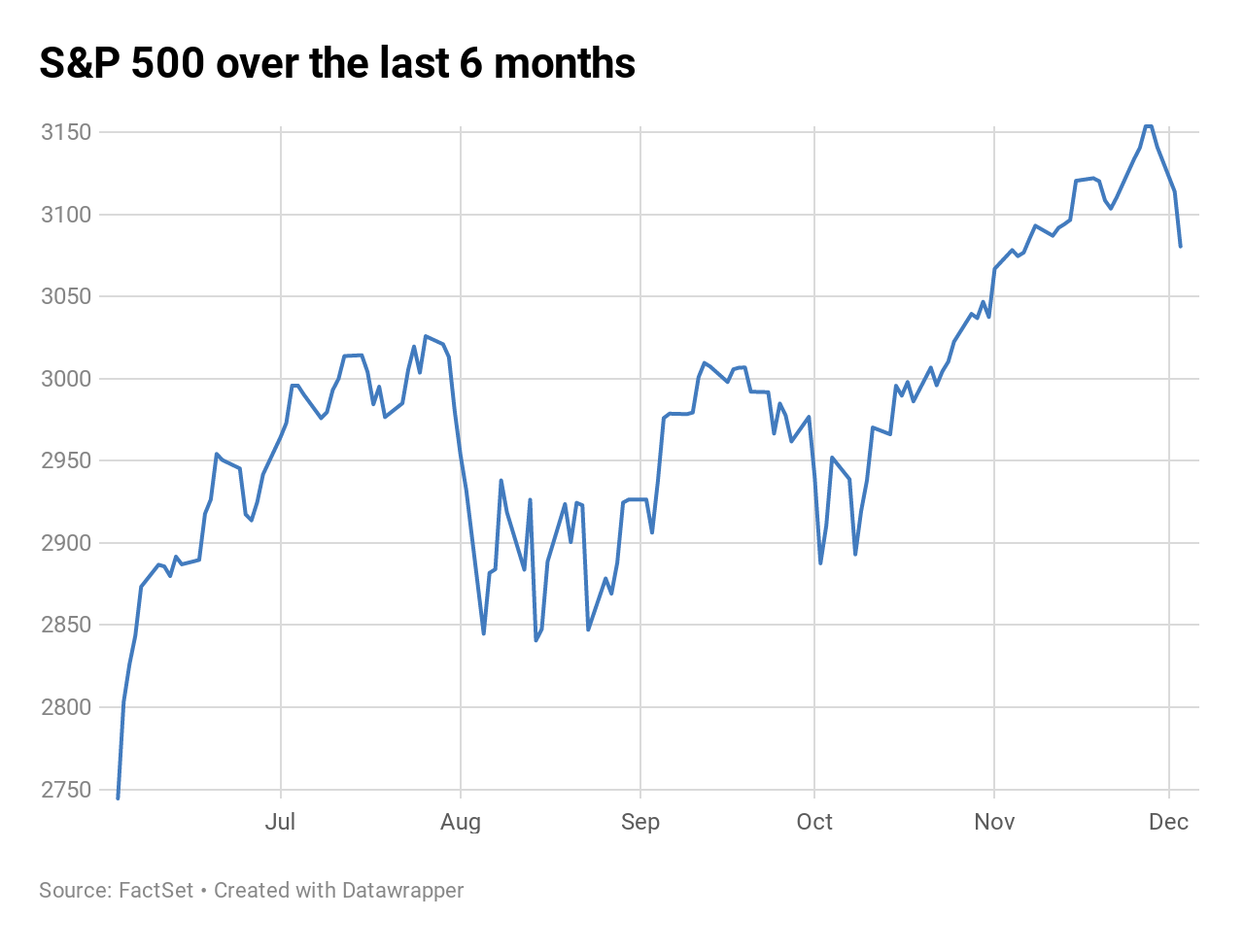

The Dow Jones Industrial Average fell more than 450 points in morning trading, led lower by trade-vulnerable Apple, Caterpillar and 3M. The S&P 500 slid 1.2% amid losses in chip stocks like Nvidia, Micron and Advanced Micro Devices. The Nasdaq Composite also lost 1.3%.

Markets hit the lows of their day after Fox News reported that the White House still plans on moving ahead with scheduled Dec. 15 tariffs on Chinese goods notwithstanding recent efforts at a “phase one” trade truce.

“In some ways, I like the idea of waiting until after the election for the China deal, but they want to make a deal now and we will see whether or not the deal is going to be right,” Trump told reporters earlier on Tuesday. When asked if he had a deal deadline, he added: “I have no deadline, no … In some ways, I think it is better to wait until after the election if you want to know the truth.”

Some stock of companies with higher-than-average overseas sales exposure underperformed the broader market: Caterpillar slid 2.7%, Intel dropped 2.4% and Apple lost 2.7%.

“The president’s objective always has been to get the right deal independently of when, or anything else like that. So, his objectives haven’t changed and if we don’t have a deal, he’s perfectly happy to continue with the tariffs,” Commerce Secretary Wilbur Ross told CNBC on Tuesday.

“I think it’s also important the president makes clear he’s under no time pressure to get it done,” Ross added. “Because otherwise there’s a tendency for the other side to say ‘[Trump] needs it for political reasons so we’ll give him a worse deal.’ He’s not going to play that game.”

The secretary added that he expects staff-level talks with China to continue, but that no high-level discussions are scheduled.

Washington and Beijing have been haggling over a “phase one” trade deal over the past several weeks, an effort seen by many investors as an attempt at a sort-of truce until the globe’s two largest economies can agree on a longer-term relationship.

Both sides have introduced tariffs on billions of dollars’ worth of imports as the disagreement escalated over the last year; additional U.S. tariffs are set to take effect on Dec. 15.

“Today’s session will hinge on the market’s interpretation of Trump’s overnight comments which concluded he has no deadline for a trade deal with China,” wrote Ian Lyngen, head of U.S. rate strategy at BMO Capital Markets.

“There are several potential reads of these remarks; the first of which would simply be to take them at face value and assume the trade war will be a semi-permanent facet of global commerce throughout next year,” Lyngen added. “There is also the very real probability he’s simply raising the stakes as a negotiating tactic.”

US President Donald Trump speaks during his meeting with Nato Secretary General Jens Stoltenberg at Winfield House, London on December 3, 2019.

NICHOLAS KAMM | AFP | Getty Images

Trump also ratcheted up economic barbs with French President Emmanuel Macron for comments he made disparaging NATO and the European country’s new digital-services tax, which was signed into law in July.

The French tax imposes a 3% tax on revenues tech companies generate in France, including targeted advertising and digital marketplaces. In response, the White House on Monday said it could impose duties of up to 100% on $2.4 billion in imports of French champagne, cheese and other luxury goods.

“Look, I’m not in love with those companies — Facebook and Google and all of them, Twitter. Though I guess I do well with Twitter,” Trump said from London. “But they’re our companies, they’re American companies. I want to tax those companies. They’re not going to be taxed by France.”

“I’m not going to let people take advantage of American companies because if anyone’s going to take advantage of the American companies it’s going to be us,” he added. The U.S. president has joined other world leaders in the U.K.’s capital city to mark the 70th anniversary of NATO.

Tuesday’s losses would add to a steep decline from the previous session and by 10:07 a.m. ET were on track to push the Dow to its biggest two-day loss since Oct. 2.

The S&P 500 dropped 0.9% on Monday, its worst one-day performance since Oct. 8, while the Dow lost nearly 270 points. The Nasdaq closed down 1% on Monday. The previous session’s pullback was sparked by disappointing manufacturing data as well as renewed trade uncertainty between the U.S. and two South American partners.

Trump announced Monday the U.S. will restore steel and aluminum tariffs on imports from Brazil and Argentina. He also suggested the move was necessary because Brazil and Argentina had been “presiding over a massive devaluation of their currencies.” However, in recent months, both countries have been seeking to strengthen their respective currencies against the dollar.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates