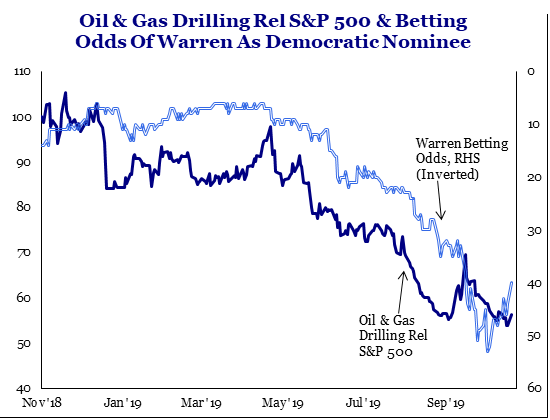

Democratic presidential candidate Elizabeth Warren has sent chills through the oil sector with her comments about banning fracking and off shore drilling, but her policies could drive oil prices higher if she were elected, according to Strategas Research.

As the prospects of a Warren nomination have grown, so has fear that the Massachusetts Senator would take action to curb the U.S. oil industry which has turned the U.S. into the world’s largest oil producer over the last decade. The U.S. now produces about 12.6 million barrels a day, more than either Saudi Arabia or Russia.

In a Sept. 6 tweet, Warren said on her first day as president, she would sign an executive order putting a total moratorium on all new fossil fuel leases for drilling offshore and on public lands. She also said she would ban fracking everywhere.

“What we’re arguing is if there is a tax placed on carbon production, or there are limits on drilling, it increases the price of the commodity,” said Dan Clifton, head of policy research at Strategas. “What’s happening here is the beneficiaries are going to be large, integrated oil companies, like Exxon Mobil, which pays a very large dividend and can withstand regulation.”

If U.S. drilling were to slow, so would U.S. exports which were first permitted during the end of the Obama administration. The U.S. exported about 3.2 million barrels of oil two weeks ago, according to the latest U.S. government data. The loss of U.S. oil both at home and abroad would mean higher prices, something OPEC and Russia have been trying to achieve through production cuts.

The U.S., in areas like the Permian basin, has become a much lower cost producer, and unlike other oil producing nations, production is guided by economic forces of supply and demand. Once the domain of small independent drillers and mom and pop companies, it has increasingly attracted the majors, like Chevron and Exxon.

Even as Saudi Arabia and Russia and others have cut back, more and more U.S. crude flowed into the world market at the same time demand growth looks set to slow.

Oil prices have been languishing, even with mounting geopolitical concerns, including the unprecedented attack on Saudi Arabian oil infrastructure last month. U.S. West Texas Intermediate oil futures were trading at just under $54 per barrel Tuesday, well off the high of just about $60 it reached when Saudi Aramco was attacked.

.1571751052277.jpeg)

Smaller oil companies, many of whom pioneered the once unconventional method of hyrdraulic fracturing, could be hurt the most. The process uses sand and water to blast into rock formations, creating many more locations to effectively drill for oil, including from places where it may have been drilled before.

“It’s early days. I think consumers are certainly staring down the barrel at much higher energy prices if she were elected,” said John Kilduff, partner and energy analyst with Again Capital.

Kilduff said it’s unlikely Congress would go along with ending fracking but there could be new rules.

“It quickly became too much of a material amount of oil. it’s too impactful. It’s just too big to ignore. You can’t just wish it away, and it has given us a level of energy security, not independence but certainly security.”

The U.S. production, in fact, has increased by about 1.5 million barrels a day in the past year, making up for the barrels lost when the Trump administration put sanctions on Iranian oil.

“She’d certainly hamstring them with regulation and take some of the lands that are now on the table, back off the table, but they don’t need those lands. But, the growth would be called into question,” he said. “They’re very environmentally exposed. With new regulation Warren could make their life a nightmare.”

Clifton said big oil, in fact, may actually seek out regulation, as the global industry faces carbon regulations else where. It may not be unlike tobacco companies during the Obama administration. “Tobacco companies asked to be regulated. They got it and it set off a bull run in tobacco stocks,” said Clifton. “It’s going to kill the small guys. The irony is Obama was good for tobacco, and Warren may be good for big oil.”

Clifton said Democrats would likely be aggressive about putting a price on carbon and regulating fossil fuels.

“This helps non-U.S. oil companies which generally already have these restrictions placed on them. Renewable energy companies also benefit from the acceleration of their products as fossil fuels get phased out,” Clifton noted. “But our most out of consensus view is that this may help large U.S. oil companies. If the price of fossil fuels are going up, the increase in the commodity price may actually help the company earnings. There is a reason Exxon has been lobbying for a carbon tax.”

Exxon was due in court in New York Tuesday, to defend against accusations from New York’s attorney general that it deceived investors over its accounting for the impact of climate change.

“After the FDA regulated tobacco, Altria locked in its 50% market share and ended lawsuits against the company. This also forced Altria’s competitors to merge and eventually regulation helped create one of the biggest bull markets for tobacco stocks and it was done under a Democratic Administration. We would not be surprised if a Democratic president actually turns out to create a bull market in oil stocks. But for the remainder of the campaign, oil stocks will be seen as negatively impacted by a Democratic win,” Clifton added.

Source: Strategas Research

In a positive for the industry, if Warren were able to shut down drilling, which would likely need congressional approval, it could send the prices of natural gas, oil and gasoline sharply higher for consumers.

“This is really bad for consumer discretionary stocks because now your’e talking about higher energy prices,” said Clifton.

Clifton said higher oil prices could impact discretionary companies, like restaurants and retailers. Those companies would also be hurt by a Warren presidency if she were able to make some changes to labor law, including on wages and contract workers.

“If it looks like she’s going to be the nominee, we’d be fading [discretionary stocks],” said Clifton.

Health care companies would also be hurt by Warren because of her plan to offer Medicare for all.

Companies, like United Healthcare and hospitals would be hurt by that plan, but Clifton expects her to modify it. He said drug companies could also be negatively impacted if Warren were to win, but less so if Trump were to take steps to curb prices during his term.

Warren would also be a negative for student lending stocks, like Sallie Mae and Navient, since she supports free college education, funded by a proposed wealth tax.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates