Here are the most important things to know about Tuesday before you hit the door.

1. FedEx earnings

Shipping company FedEx reports fiscal second quarter earnings after the bell on Tuesday. Wells Fargo is forecasting earnings per share of $2.83 on revenue of $17.76 billion. In the same quarter last year, FedEx reported earnings of $4.03 per share on revenue of $17.82 billion.

Wells Fargo said all eyes will be on the company’s full year guidance, which currently stands between $11 and $13 per share. The firm said FedEx could lower guidance as uncertainty about international trade issues, impacts on the global economy and shipping volumes weigh on FedEx.

Shares of FedEx fell on Monday on news that Amazon will block its third party sellers from using FedEx’s ground delivery network for Prime shipments, citing a decline in performance heading into the final stretch of the holiday shopping season. Last week, Morgan Stanley said e-commerce giant Amazon is already delivering about half of its own packages in the U.S., and will soon pass both United Parcel Service and FedEx in total volume. Wells Fargo said e-commerce trends continue to be a growth opportunity for FedEx.

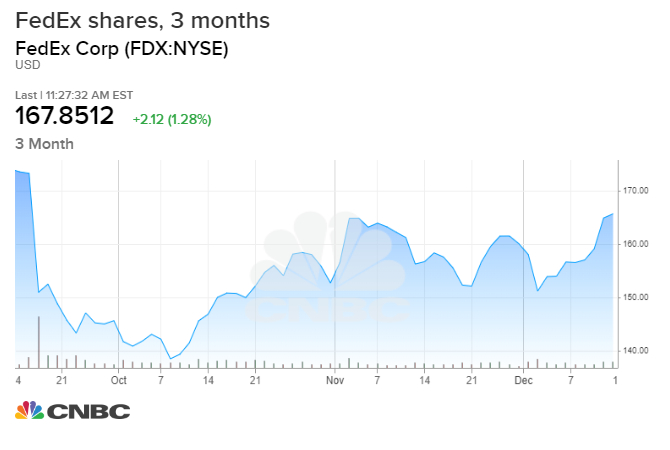

Shares of FedEx are down about 3% in the past three months.

2. Homebuilding and jobs data

We’ll get a read on the health of homebuilding on Tuesday with housing starts data set to release at 8:30 a.m. Housing starts are expected to rise 2% to 1.34 million in November, according to economist polled by Dow Jones. This is a smaller rise than the 3.8% jump to 1.314 million in October, which was a 12-year high. Homebuilder confidence jumped to its highest level in 20 years in December, the National Association of Home Builders/Wells Fargo Housing Market Index said on Monday.

Industrial production and the Labor Department’s Job Openings and Labor Turnover Survey will also be released on Tuesday. Economists polled by Dow Jones are expecting industrial production to rise 0.8% in November, after slumping 0.8% in October. Job openings for October are expected to come in at 7.02 million, the same as September’s reading, the lowest level since March 2018. The so-called JOLTS survey is closely watched by Federal Reserve officials for clues on the employment picture.

3. Eli Lilly 2020 outlook

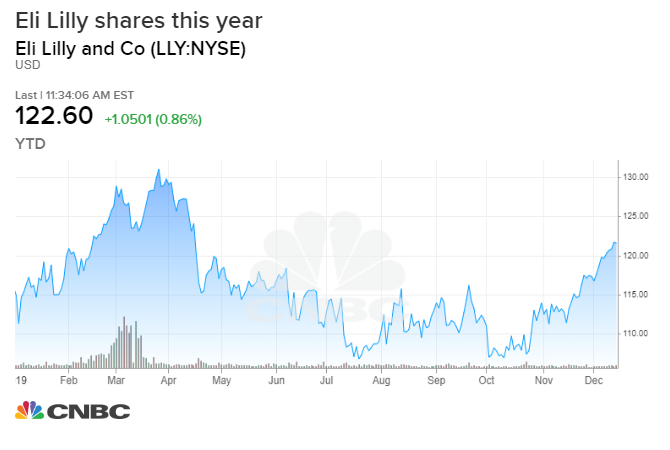

Drug manufacturer Eli Lilly will hold a conference call on Tuesday where it will issue its full year 2020 guidance. Ahead of the call, Cowen raised its 2020 earnings forecast to $6.80 per share, compared to the $6.40 per share earned in 2019. Some investors are cautious about increased competition, particularity in the diabetes drug-space.

“We continue to rate LLY Outperform as above average growth should overweight concerns related to competition to key franchises and pipeline visibility,” said Cowen analyst Steve Scala in a note to clients on Monday. Cowen has a $145 per share price target on the stock, which last traded at $122.8 per share.

Shares of Eli Lilly are up nearly 6% year to date.

Major events (all times ET):

8:00 a.m. Dallas Fed President Robert Kaplan speaks

8:30 a.m. Housing starts

8:30 a.m. Business leaders

9:00 a.m. Eli Lilly webcast

9:15 a.m. Industrial production

10:00 a.m. JOLTS

12:30 p.m. New York Fed President John Williams speaks

1:00 p.m. Boston Fed President Eric Rosengren speaks

Major earnings:

Steelcase (before the bell)

FedEx (after the bell)

Cintas (after the bell)

— with reporting from CNBC’s Michael Bloom.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates