Laura Williams thought she had sensible money habits. She always put money aside. She spent less than she earned.

The Norfolk, Virginia resident, owner of online client-management platform Client-portal.io, thought she had a pretty good bead on her finances.

When she was in her late 20s, it became apparent to Williams that her eventual retirement someday might not be the slam dunk she assumed it would be.

“I started thinking about the people I knew who were retired and the lives they were living,” said Williams, now 30. “Some were living pretty nice lives, and some were really struggling.”

More from Invest in You:

Rent or buy refurbished so you can put money into a true investment

Make these 5 tweaks to your summer spending so you’re richer this fall

You’ll probably regret that timeshare. You may not need monthly car payments.

She tried visualizing what retirement could mean and how she could accumulate enough money to be comfortable. “It’s all very well and good having savings, but is that enough?” Williams said she wondered.

Retirement, she realized, could be 20 years or even longer.

When she started digging into the numbers, she began coming across estimates of $1 million or more. It was daunting, to say the least.

So Williams went back and compared her two groups of retirees.

“The difference between people who seem to live quite well in retirement and those who don’t was investments,” she said.

No time like the present

Like lots of millennials, Williams knew some people invested, but she wasn’t one of them. In her late 20s, she wasn’t putting anything aside for retirement.

The roadblock for many younger investors is the fear that they’re not knowledgeable enough.

Laura Williams and her husband, Brennan Dunn, save far more each week than they would if they’d started earlier.

Source: Laura Williams

“People assume that to get started you have to have an absolute command over investing,” said Jennifer Dempsey Fox, a certified financial planner and president of Bryn Mawr Trust Wealth management in Bryn Mawr, Pennsylvania.

Asking questions is a new investor’s best strategy.

“I know it’s kind of trite but there is no such thing as a stupid question when it comes to investing,” Fox said. “Especially if it’s holding you back from the next step.”

Young people are often confronted with an overwhelming number of decisions. “Where should they put the money first?” said Adam Vega, a CFP at United Capital in Miami.

“Pay off loans? Save? What I’ve seen them do is start, but start too late,” said Vega. “They’re in their 40s or 50s when they finally begin investing.”

If you wait until you’re more settled and more knowledgeable, “you’ve lost 20 years of saving potential,” Vega said. It seems to be a more or less static problem for this age group, and one Vega does not see changing.

Good financial habits are a great starting point, yet starting to invest as early as possible is the best way to meet substantial goals. “Begin early,” Vega said, “so you can take advantage of tax deferrals, compound interest and interest on your interest.”

Take that first step

“As much as people can save, they should save,” Vega said. Whether it’s $100 or $1,000, start with any amount and gradually increase.

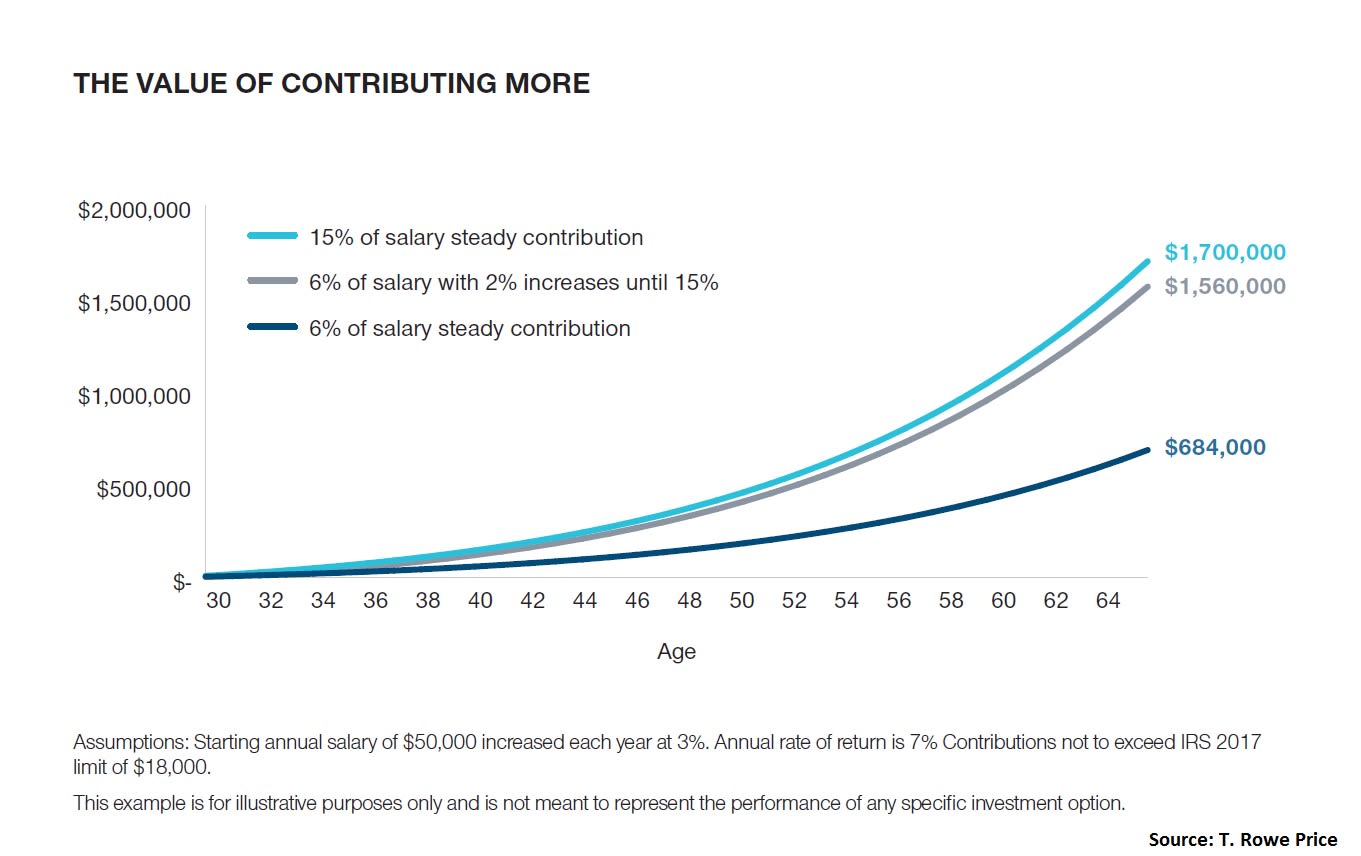

Build the habit of saving and investing, and when you start to see some results, it becomes easier. Vega recommends setting checkpoints so you can realize your accomplishments when you hit that first $1,000. (Click on chart below to enlarge.)

Don’t get discouraged by unrealistic numbers. The recommendations to save $1 million or $2 million can be off-putting. “You feel you’ll never have enough,” Vega said.

Vega’s solution? “Don’t look at those numbers,” he said. “You’ll never start saving if you do.”

Not for millionaires only

Williams started thinking about retiring someday but, looking at her finances, she didn’t see that happening unless she changed some of her strategies.

“I have money in the bank but when it’s sitting in the bank, it’s not doing anything for me,” Williams said.

It was a revelation that money in the bank or in a low-interest savings account could mean actually losing money because it wouldn’t keep pace with inflation.

She began reading Ramit Sethi’s “I Will Teach You To Be Rich,” a personal finance best-seller aimed at people ages 20 to 35.

“I wanted to look into where I’d put that money where it wouldn’t be too risky but would give me a really good return,” Williams said. She began exploring robo-advisors, which she found appealing because they allowed her to set a comfortable level of risk without an exhaustive amount of research.

If I’d started when I was 24, I’d have been able to put away a very small amount of money that would have been beneficial to me when I‘m 65.

“What frustrates me is I didn’t start earlier,” Williams said. “If I’d started when I was 24, I’d have been able to put away a very small amount of money that would have been beneficial to me when I‘m 65.”

The idea of investing always conjured up an image of old men in suits for Williams.

To her surprise, she learned that she could control how much risk to take on and learn enough about investing to feel more comfortable. Different types of people invest, and you don’t have to be a millionaire.

“It’s for regular people, and for young people, and actually it’s a very smart thing to do,” Williams said.

Together with her husband, she uses automatic payments to save about $900 a week. “We haven’t noticed a huge difference in our quality of life, and we have a decent-sized investment,” she said.

But, she says, if they’d started earlier, they could be investing at a lower rate and now be in the same place.

Check out Airbnb superhost brings in $34,000 a year in Georgia−here’s how he got started via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates