Uber could still make a U-turn.

That’s according to JC O’Hara, chief market technician at MKM Partners, who told CNBC’s “Trading Nation” on Friday that breaching one key level could greatly bolster the stock’s bull case.

Uber shares have endured a great deal of push-and-pull in recent days, sent higher on Friday by positive analyst notes from Stifel and SunTrust, but tipped into a 1% decline on Monday after the city of London stripped the ride-hailing giant of its license to operate there — Uber’s biggest European market. The order is on hold as Uber appeals the decision.

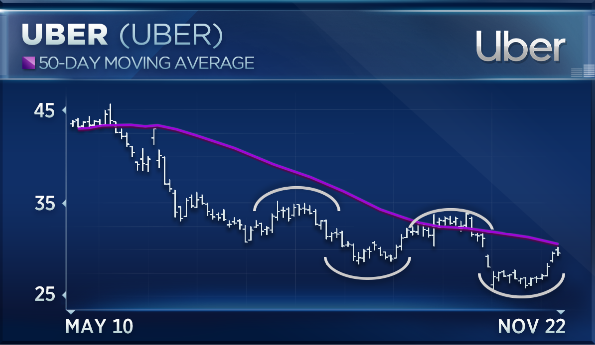

Looking at Uber’s chart since its IPO — which, as of Monday, displayed a painful 36% decline from the debut price — O’Hara saw some hope for the stock.

“I can really appreciate this recent short-term positive momentum, especially after we got past the lockup expiration earlier this month,” O’Hara said. Since the on Nov. 6, current and former insiders including ex-CEO Travis Kalanick,have sold large blocks of shares.

“But … if we take a step back and look at the six-month chart, we find that we are still in a defined downtrend,” O’Hara said. “We have price trading below a declining 50-day moving average. We have a series of lower highs in place as well as lower lows. So, I think it might be too premature to say the worst is behind us.”

Still, O’Hara said one level would determine Uber’s ability to turn around.

“If we do manage to push up and break above the October highs in that $34-35 area, I think I would be a little bit more confident at that point in time that the worst is behind us, and the base suggests that we can move higher at that point,” the technical analyst said.

Uber shares were just above the $29 level in early Monday trading.

Steve Chiavarone, equity strategist, vice president and portfolio manager at Federated, wasn’t as confident that Uber could find an upward catalyst.

“I think scalability is the issue,” Chiavarone said in Friday’s segment. “We focus on incremental margins. You’ve got insurance costs here that grow as the company expands, and that raises questions about scalability. So, as we evaluate IPOs, particularly through our Kaufmann Growth franchise, what we’re looking for is companies that are asset-light, can scale the business and are generating incremental margins. I’m not sure we find that here.”

Chiavarone added that his firm was not yet exposed to the ride-hailing space, citing its stringent guidelines for investing in newly public names.

“What we’re looking for are those companies where we can see a clear pathway to cash-flow growth because that ultimately is going to be where the value is, and so we have not played this space,” he said.

Earlier this year, Uber CEO Dara Khosrowshahi told CNBC that he expected the company to be profitable by 2021.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates