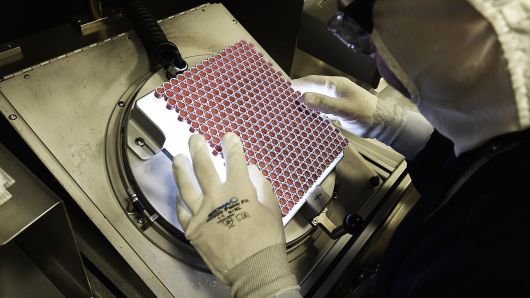

Frederick Florin | AFP | Getty Images

An employee works on the production of insulin pens at the factory of the US pharmaceutical company Eli Lilly in Fegersheim, France.

Eli Lilly shares are attractive due to the drug maker’s strong pipeline, according to J.P. Morgan.

The firm resumed coverage on Eli Lilly shares with an overweight rating, predicting the company’s profit margins will surge over the next few years.

We “see Eli Lilly as fundamentally one of the best positioned names in our group with healthy core product growth (Trulicity, Taltz, Jardiance, etc) and a next wave of late stage pipeline assets,” analyst Chris Schott said in a note to clients Wednesday. “Eli Lilly offers combination of top tier growth and high levels of diversification.”

Eli Lilly shares are up 1.3 percent Wednesday.

Schott started his Eli Lilly price target at $117, representing 11 percent upside to Tuesday’s close.

The analyst noted no drug represents more than 15 percent of the company’s sales. He predicts Eli Lilly’s operating profit margin will rise to 36 percent by 2024 versus the estimated 27 percent this year.

“We see solid Rx trends for the company’s core portfolio of new product launches (Trulicity, Taltz, Jardiance, Basaglar) translating to an ongoing upward bias to estimates,” he said.

Eli Lilly shares are up 25 percent this year through Tuesday versus the S&P 500’s 9 percent return.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates