For investors pondering if January’s comeback is a revival of the bull market or just a bounce before the coming bear, the market is about to tell them, according to J.P. Morgan’s chart analyst.

The market is still not out of the woods yet even after the S&P 500 rebounded from its worst December since 1931, posting a more than 5 percent gain in just four weeks of the new year. The benchmark is up more than 12 percent from its Christmas Eve low when it dipped into a bear market on an intraday basis.

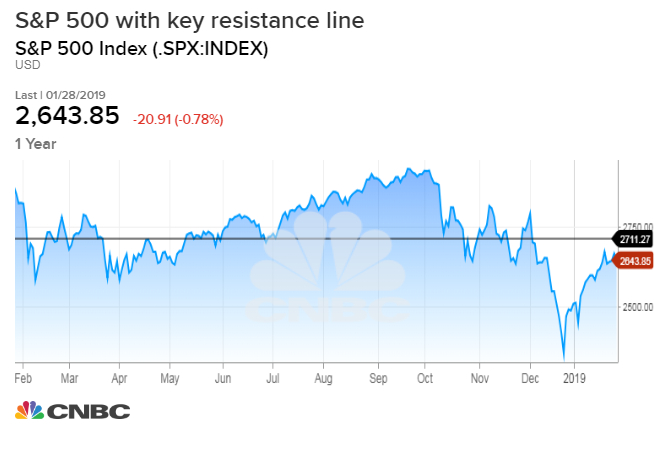

The confirmation on whether the bull market is still alive will come if the benchmark breaks out over the key resistance parameter — 2,713, which is about 70 points above the trading level on Tuesday, according to J.P Morgan’s Jason Hunter.

“The S&P 500 Index rebound was able to extend through the 2,585-2,630 range lows, but still has a lot of wood to chop overhead. The next confluence of resistance rests at 2,713-2,741. We view that zone and other nearby levels as a critical inflection for the rebound and dividing line between bear market mean reversion versus a resumption of the longer-term bull cycle,” Hunter said in a note to clients on Monday.

The analyst decided that level is key looking at a combination of Fibonacci retracement levels, and the 100-day and 200-day moving averages.

The analyst added that as long as the S&P 500 stays above 2511 for the first quarter, he will remain bullish.

Stocks have since recovered on the optimism of a trade resolution with China, upbeat earnings, and a shift in U.S. monetary policy. Now the market has come close to a tipping point to prove the January rally is not just a bear market rebound, but it has a few hurdles to clear before it gets there.

“Given the nature of the macro risks, a definitive breakout will likely correspond with constructive news headlines. Ultimately, the current market is left to determine whether or not the tentative de-escalation of the U.S.-China trade war, shift in U.S. monetary policy, and Chinese fiscal stimulus combine to provide enough stimulus to prolong the economic expansion and U.S. equity bull cycle,” Hunter said.

While J.P. Morgan doesn’t expect the market to break through until later in the first quarter, the recent price action, sector performance and “cross-market signals” have made the bank’s analysts more optimistic.

There are other factors that the analyst believes paint a bullish picture in the charts including strong relative performance by chip and bank stocks. Those sectors may give investors an early signal whether the market can break out.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates