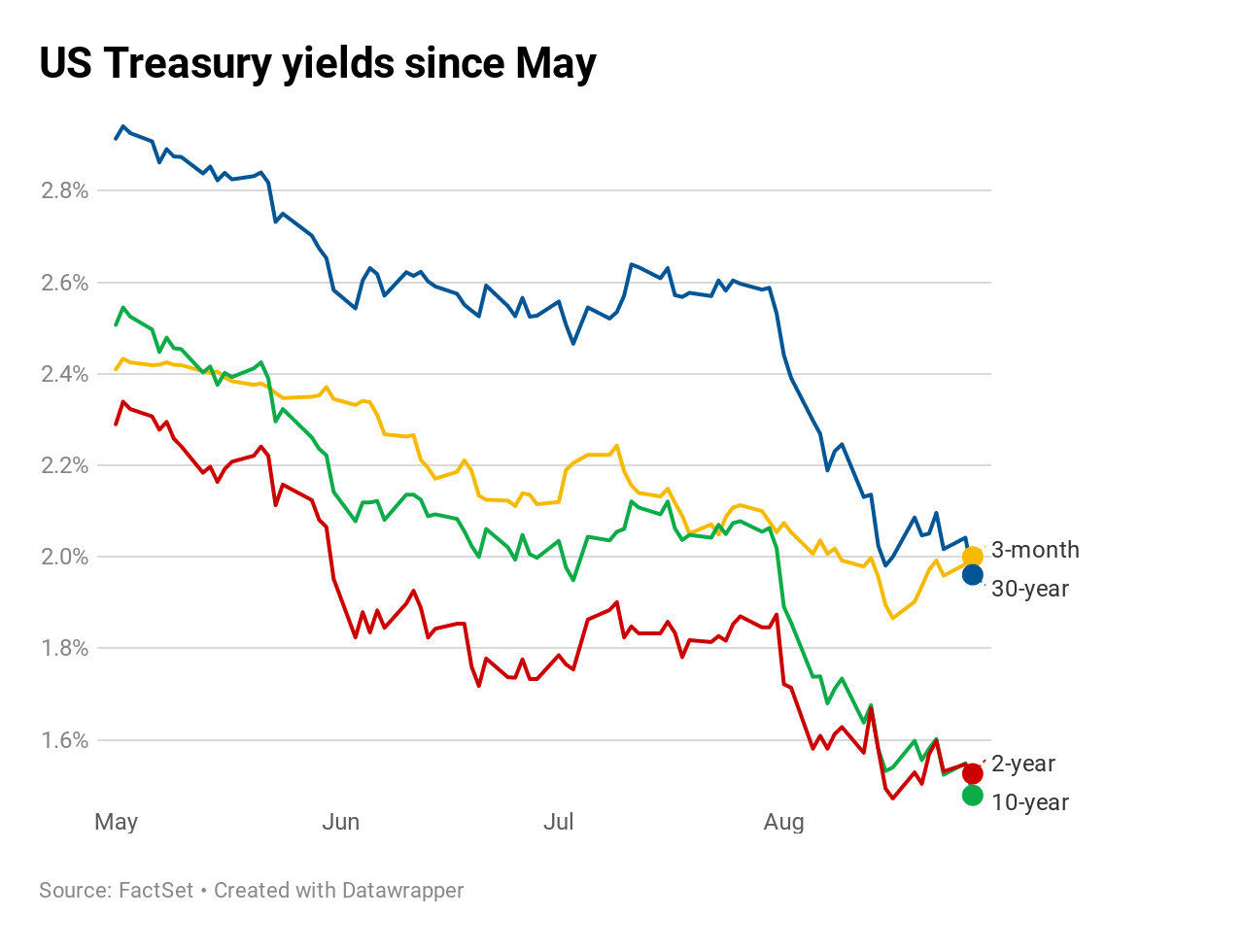

Long-term Treasury rates added to their monthlong slide Tuesday, aggravating a key yield curve inversion and sending the 10-year yield to its lowest level against the 2-year rate since 2007.

The yield on the benchmark 2-year Treasury note, more sensitive to changes in Federal Reserve policy, fell to 1.526%, 5 basis points above the 10-year note’s rate of 1.476% after closing inverted on Monday. Before August, the last inversion of this part of the yield curve was the one that began in December 2005, two years before the financial crisis and subsequent recession.

The spread between the 3-month Treasury yield and that of the 10-year note — the Fed’s preferred inversion metric — slumped to -52 basis points, its lowest since March 2007.

The 30-year bond yielded 1.955% and was poised to close below the 3-month bill yield for the first time since 2007.

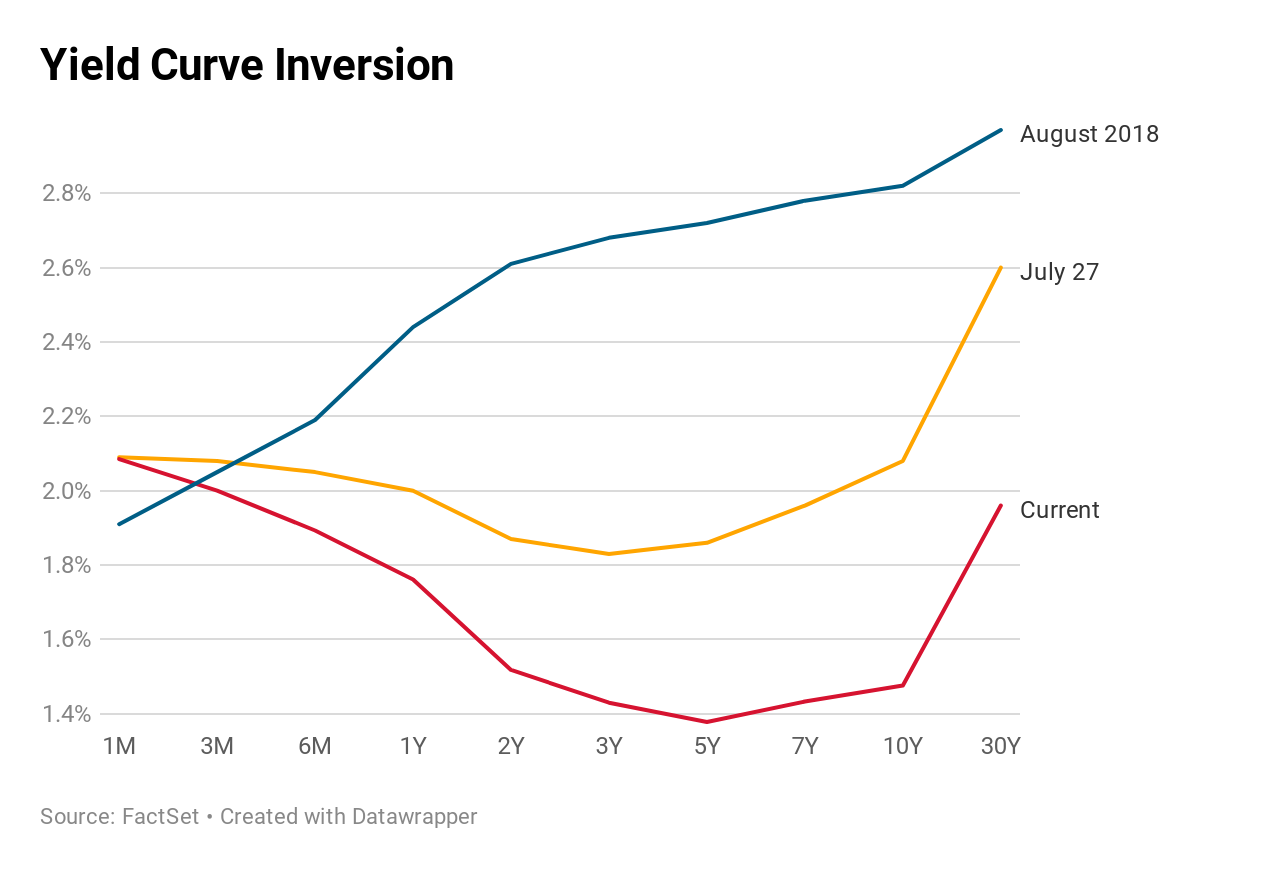

A 10-year rate below the 2-year yield is viewed by fixed income traders as an important recession prognosticator, marking an unusual phenomenon as bondholders receive better compensation in the short term. The Dow Jones Industrial Average retraced a 155-point gain on Tuesday as bond yields fell.

In fact, the 2-year rate has exceed that of the 10-year ahead of every recession over the past 50 years and the last five 2-10 inversions have all led to recessions. Timing any forthcoming recession, however, is tougher: Even when an inversion does predict a recession, the yield curve inversion is, on average, 22 months early, according to Credit Suisse.

The worsening inversion is “certainly validating that a recession has a great chance of being here a year, year and a half from now,” said Kevin Giddis, head of fixed income capital markets at Raymond James.

Much of the market’s angst is a function of “what investors think the Fed’s going to do and the delay in the U.S.-China trade agreement,” he added.

Tepid inflation expectations and the Fed’s perceived inability to goose prices higher, Giddis said, offer a compelling reason to continue to buy 10-year and 30-year debt. Investors tend to sell Treasurys when inflation is high because it erodes the purchasing power of bonds’ fixed payments. Bond yields move inversely to their prices.

The Fed tries to keep inflation around its 2% target, a pace it feels is both healthy and sustainable for the U.S. economy. But despite historically low interest rates, price gains have remained tame.

Consumer prices as measured by the personal consumption expenditures (PCE) price index, the Fed’s favorite inflation gauge, edged up 0.1% in June as food and energy prices fell. In the 12 months through June, the PCE price index rose 1.4% after a similar increase in May.

The Treasury Department auctioned $40 billion in 2-year notes at a high yield of 1.516%. The bid-to-cover ratio, an indicator of demand, was 2.6. Indirect bidders, which include major central banks, were awarded 47.1%. Direct bidders, which includes domestic money managers, bought 20.4%.

Though explanations for the market’s Tuesday moves were few, some pointed to comments by President Donald Trump following the Group of Seven summit on Monday. Trump said that China was sincere about a trade deal with the U.S., though his claim that Chinese representatives called top U.S. trade negotiators on Sunday night to resume talks has been disputed by Beijing.

Short-term yields were buoyed ahead of a string of auctions; the Treasury Department will sell $40 billion in 2-year Treasury notes, $41 billion in 5-year notes and $32 billion in 7-year notes.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates