Tech stocks fell on Monday, June’s first day of trading, amid reports that the U.S. government is planning to target a host of big companies in the industry with antitrust and business practice probes. Shares of Alphabet, Amazon, Facebook and Apple all weighed on the market during Monday’s session.

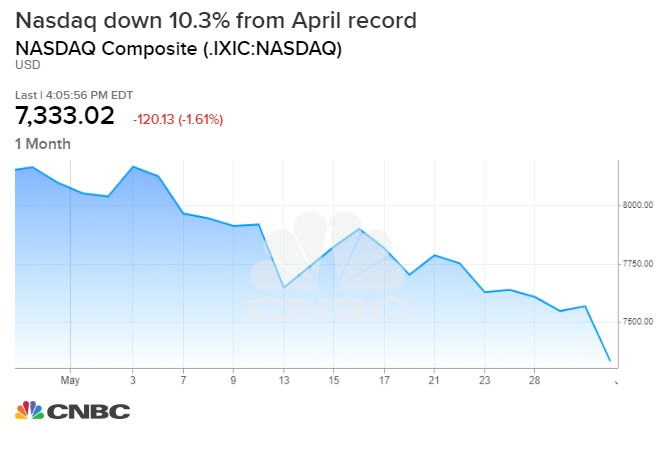

The Nasdaq Composite dropped 1.6% to enter correction territory, closing more than 10% below its record high set in late April at 7,333.02. The S&P 500 slid 0.3% to 2,744.45 while the Dow Jones Industrial Average ended the day just above breakeven at 24,819.78.

Alphabet shares pulled back 6.1% after reports said the Justice Department is preparing to launch an antitrust probe on Google. Meanwhile, Facebook dropped 7.5% after The Wall Street Journal reported the Federal Trade Commission would be able to look into Facebook’s practices and how they impact digital competition.

“The whole component of what’s going on in tech right now goes back to the rhetoric of Sen. Elizabeth Warren threatening to break up tech giants,” said Jeff Kilburg, CEO of KKM Financial. “We thought that was just rhetoric. But now with this news hitting, it’s really impactful.”

Amazon shares fell 4.6% after The Washington Post said an arrangement between the Federal Trade Commission and the Justice Department put the e-commerce giant under the FTC’s microscope. Apple also slipped 1% after Reuters reported the Justice Department received jurisdiction to investigate the company’s practices.

Communications services, consumer discretionary and tech were the worst-performing sectors in the S&P 500 on Monday. Communications dropped more than 2.5%, its biggest one-day drop since late October, while consumer and tech both closed more than 1% lower.

“With the trade stuff going on, [big tech] has been a bit of a hiding place,” said Christian Fromhertz, CEO of The Tribeca Trade Group. “You just can’t hide right now.”

Mark Zuckerberg, chief executive officer and founder of Facebook Inc. attends the Viva Tech start-up and technology gathering at Parc des Expositions Porte de Versailles on May 24, 2018 in Paris, France.

Christophe Morin/IP3 | Getty Images News | Getty Images

Trade worries also weighed on the broader market.

Chinese Vice Commerce Minister Wang Shouwen said in a white paper Sunday that Washington would not be able to use pressure to force a trade deal on Beijing. He also refused to say whether the leaders of both countries would meet at the G-20 summit to work out an agreement later this month.

Wang added: “The U.S. has backtracked, and when you give them an inch, they want a yard.”

The remarks from Wang follow a month of heightened trade tensions between the world’s largest economies. The U.S. hiked tariffs on $200 billion worth of Chinese goods in May. China retaliated with higher tariffs on U.S. imports.

“This issue with China continues to be the big elephant in the room,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab. “If the two sides, China and the U.S., break down on these negotiations, we could see a 10% correction. We’re more than halfway there already and talks haven’t broken down yet.”

“There just aren’t a lot of things out there to drive the market so this issue continues to be the pivotal point,” Frederick said.

The benchmark 10-year U.S. note yield fell its lowest level since September 2017. Gold prices climbed to their highest point since late March, breaking above $1,320.

Trade worries also rattled Wall Street last week after President Donald Trump threatened to slap a 5% charge on all imports from Mexico. The threat sent stocks tumbling on Friday.

U.S. manufacturing activity in the U.S. fell last month to its slowest pace of growth since October 2016, according data from the Institute for Supply Management. The pace of expansion also disappointed economists polled by Refinitiv.

St. Louis Federal Reserve President James Bullard said Monday that a rate cut “may be warranted soon ” given the risks of rising trade tensions.

—CNBC’s Sam Meredith contributed to this report.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates