The crude crush continues.

Oil prices reversed on Tuesday to fall nearly 6% after surging over the weekend and on Monday, a monster move that followed a set of coordinated attacks on Saudi Arabia’s oil supply. The pivot came after the Saudi energy minister said the kingdom would have its oil supply back online by the end of the month.

And, judging by crude’s track record, a return to its longer-term downtrend seems like an appropriate direction for the commodity, said Anthony Grisanti, longtime trader and founder and president of GRZ Energy.

“I’m going to look at the bigger picture, and the bigger picture was that before this all started, oil prices were sliding,” Grisanti said Tuesday on CNBC’s “Futures Now.”

Grisanti — who was a seller of crude oil futures in Tuesday’s session — said three key factors made him believe that oil would continue to sink: demand, fracking and global supply.

“Seasonally, demand is weak, and then if you look at U.S. fracking, we’re over 13 million barrels a day. This market would’ve been $20 higher yesterday if fracking didn’t exist the way it exists right now,” Grisanti said. “And … you have some spare capacity with Russia, with Venezuela — although I don’t know how fast they can get that online — and a few other countries. So, there is oil out there, the market was very well supplied before all this started, and … it all hinges on how fast the Saudis can get that production back.”

As such, Grisanti decided to sell November contracts in U.S. West Texas Intermediate crude oil at $59.70, with a stop at $61.10 and a target of $57.00.

That represents a bet that crude — which was trading around the $59.40 level later on in Tuesday’s session — would fall about 4% by the end of November.

“I think the market’s going to chop around a little bit, and I’m hoping that we don’t get back above [$]61.00, obviously, because that’ll stop me out,” Grisanti said. “The pressure’s on.”

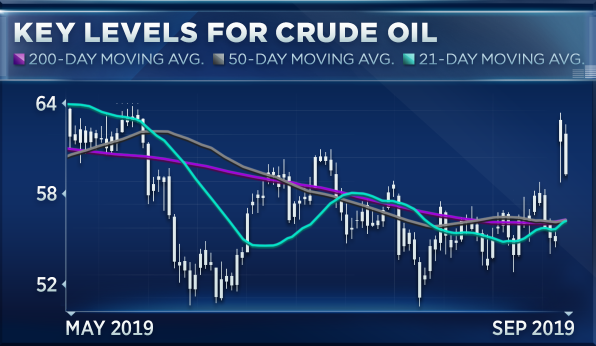

The trader also flagged some interesting action in oil’s 200-day, 50-day and 21-day moving averages, all of which have converged right around the $56.20 level.

“Ultimately, we could get back to that level, but that’s going to be the real big support,” he said. “We’re looking for a small draw tomorrow when supply numbers are released. If we happen to get anything of a build, you’re going to see them test that [$]58.70 level again and possibly that [$]56.20 level.”

Brian Stutland, chief investment officer at Equity Armor Investments, said oil’s floor of support could be even lower, around the $50-$55 range.

“There at least will be a geopolitical risk premium put on it. So, if we get oil prices down to there, they will struggle, I think, to go lower because of that factor,” he said in the same “Futures Now” segment. “For that, I would be bearish like Anthony is to the downside here, too, I just think there’s a level where we stop.”

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates