Philip Morris International is in discussions with Altria about a possible all-stock, merger of equals, the tobacco giants announced Tuesday.

The companies did not disclose the stake each would expect to hold in a newly combined company, but people familiar with the talks told CNBC that PMI and Altria are weighing a 59%-41% split, respectively. The deal would result in a divided board and management, the people said, requesting anonymity because they are not authorized to speak publicly. The current deal being discussed does not envision a premium for shareholders of either company.

Talks intensified this summer, and a deal could be announced within weeks, the people said.

A deal, if one is reached, would reunite Philip Morris International and Altria more than a decade after the two companies split. Altria spun off PMI in 2008 and has remained a largely U.S.-focused company, selling Marlboro cigarettes domestically while PMI has focused on selling cigarettes overseas.

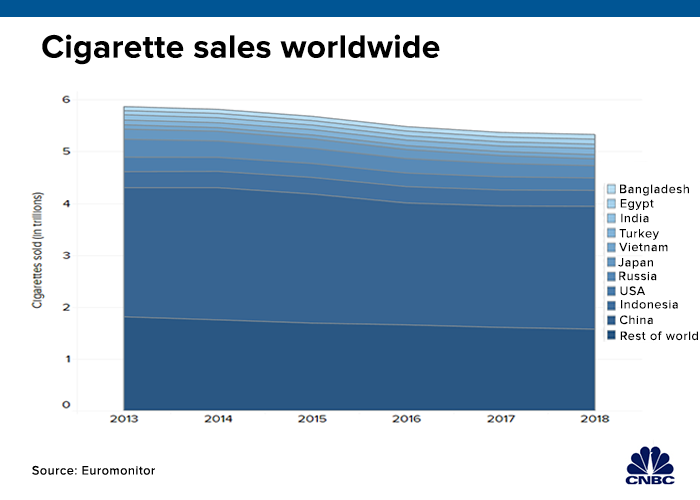

Cigarette sales fall

Analysts have long speculated that the two companies would come back together. The talks come at a time when cigarette sales are falling and both companies are searching for new ways to grow. Combining Altria and PMI would create a global tobacco powerhouse with investments in e-cigarettes and cannabis.

PMI’s shares lost nearly 8% on Tuesday, closing at $71.70 a share, while Altria’s fell about 4%, closing at $45.25 a share. PMI’s shares were pressured Monday amid merger speculation. Altria’s stock initially rose Tuesday morning when the talks were confirmed, but later gave up those gains after it was reported that shareholders wouldn’t receive a premium. At the same time, PMI shares recouped some of their losses.

Before the announcement, PMI’s market value stood at around $121 billion while Altria’s outstanding stock was valued at roughly $88 billion. Wells Fargo analyst Bonnie Herzog in a note to clients Tuesday said she was “excited” about the discussions and she has “long believed a combination of the two companies would make a lot of sense.”

PMI in a press release cautioned that it’s possible the talks do not result in a deal. Any move would need to be approved by the companies’ respective boards, shareholders and regulators, as well as meet “other conditions.”

Searching for growth

At the time Altria and PMI split, cigarette sales were increasing overseas while they were falling in the U.S. International sales have been declining since 2012. PMI’s global cigarette shipment volume fell 3% in 2018 from 2017, according to the company’s annual report.

In the first half of this year, PMI’s cigarette volume dropped by 1.9%, with steep declines in countries like Russia.

Combining Altria and PMI would create a more than $200 billion company, allowing the new corporation to invest in research and development and innovate for the coming decades, people familiar with the talks said. Both companies have already made big bets on alternative products.

PMI has spent more than $6 billion developing iQOS, a heated tobacco device, that’s already been introduced in 48 markets around the world and was cleared by U.S. regulators in April. The company plans to bring it to the U.S. next month. PMI said it has about 11 million iQOS users globally.

The Food and Drug Administration cleared iQOS for sale earlier this year. Altria will license iQOS from PMI and market it in the U.S. as part of a previously negotiated deal.

Pot, vaping

Meantime, Altria has invested $12.8 billion in Juul for a 35% stake in the biggest e-cigarette company in the nation. Regulators have yet to approve the deal, and Juul has since faced mounting litigation, criticism and pressure from both lawmakers and regulators.

Altria has justified the eye-popping investment on Juul’s potential for international growth. While Altria is helping Juul expand its reach in the U.S., the company has little assistance to offer overseas. Combining with PMI could change that.

Altria also spent $1.8 billion for a 45% stake in Canadian cannabis company Cronos. The two companies are focusing on developing vapor products.

Both Juul and Cronos could provide growth the companies can’t get with cigarettes. However, PMI CEO Andre Calantzopoulos has not been shy about his discomfort with the other industries. Calantzopoulos has publicly criticized Juul for fueling a teen vaping “epidemic” in the U.S. He has also said he is not interested in cannabis despite medical use and legalization efforts around the globe.

“The whole thing I would say, is Juul, I hope they learned their lessons regarding certain undesirable target audiences that we’re very careful and extremely wise about,” Calantzopoulos told analysts on an earnings call in February. “And I hope that the Altria participation will increase their attention to unintended audiences. That’s all I have to say.”

PMI generated $79.82 billion in revenue, including excise taxes, last year, according to a regulatory filing. Altria posted $25.36 billion in sales last year. PMI’s shares are up 7.4% this year, while Altria’s shares are down 8.4%.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates