IBM’s stock tanked after earnings and investors should not expect the situation to improve any time soon.

The technology company issued weaker-than-expected revenue for the third quarter, marking the fifth-straight quarter of falling revenue.

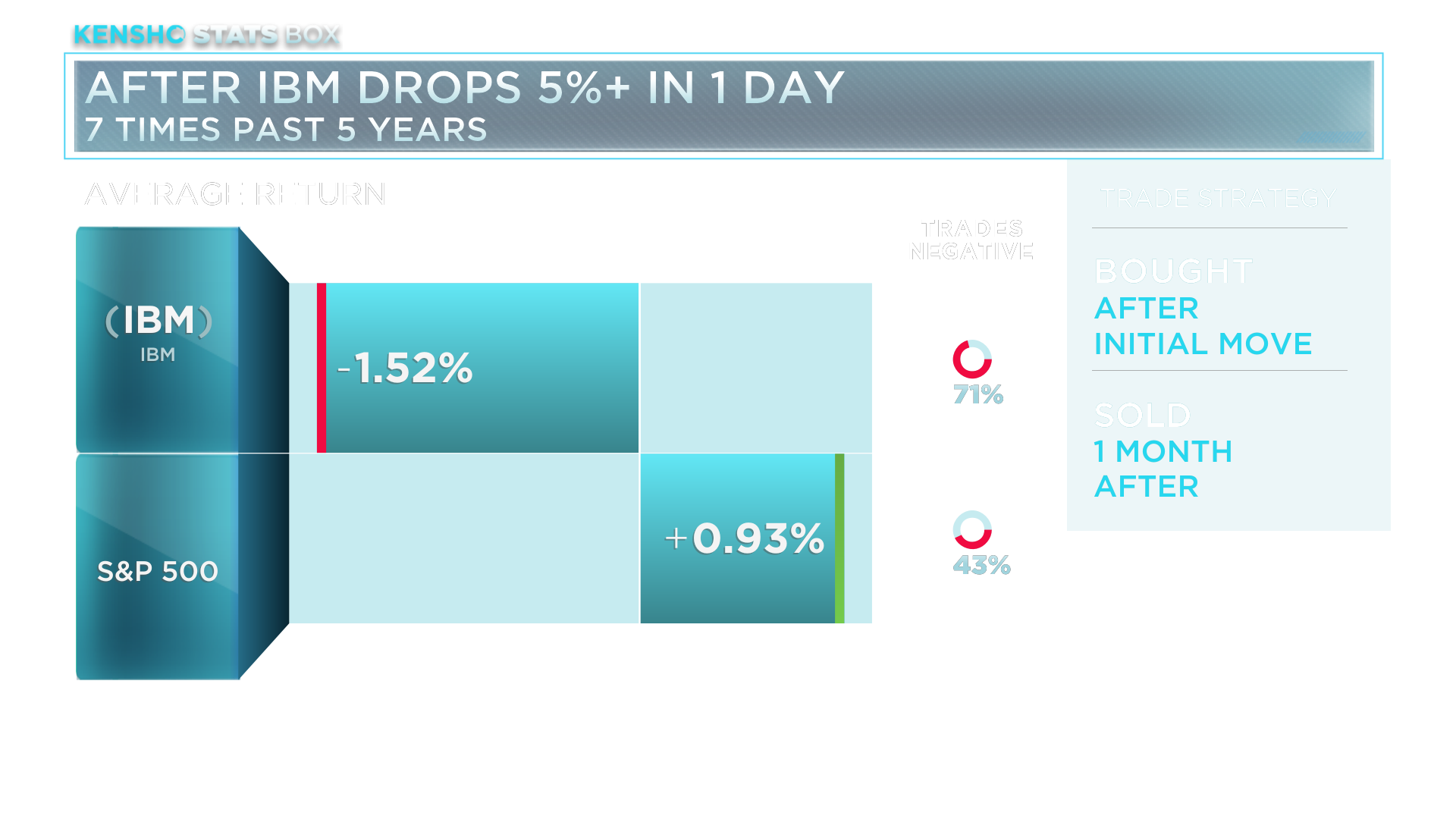

IBM shares dropped over 5% after its Wednesday earnings. The stock stayed down on Thursday and it could face more negative pressure in the weeks ahead based on an analysis of recent trading history.

A month after similar declines, shares of IBM trade negatively 71% of the time, and underperform the broader stock market, according to hedge fund analytics tool Kensho. The similar negative trading periods that were studied occurred seven times across the past five years.

In the third quarter, IBM had lowered its full-year earnings estimate to take into account the impact from its acquisition of Red Hat, among other factors.

The company’s cloud business has not done enough to offset sluggish sales in its services, hardware and financing businesses. Even with contributions from Red Hat, an acquisition that closed in the third quarter — and Red Hat revenue growing 19% in the quarter on a normalized basis which was better than its growth rate during its last quarter as an independent company — IBM’s Global Technology Services unit, its largest, struggled with revenue of $6.7 billion down 5.6% from the year ago period and slightly below the consensus estimate.

Some Wall Street analysts remain positive on IBM.

“We think the combination of new products should enable the company’s Systems segment to revert to growth in CY20 following recent declines (wind down of z14 cycle),” Evercore ISI analyst Amit Daryanani, who has the equivalent of a buy rating on IBM stock, wrote in a note distributed to clients on Monday.

IBM shares are up about 25% since the beginning of the year.

IBM said it continues to forecast at least $12.80 in earnings per share, for the full year 2019. It beat by a penny in the third quarter — $2.68 per share vs. $2.67 analyst expectation. Analysts polled by Refinitiv expect $12.81 in earnings per share for the year.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates