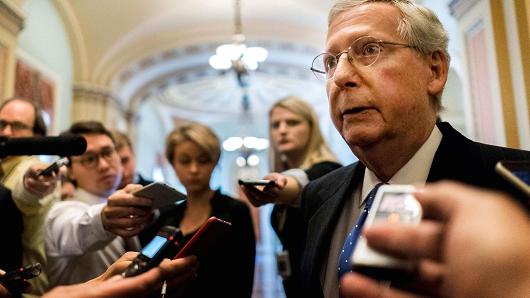

Melina Mara | The Washington Post | Getty Images

During a day of meetings about the Republican tax bill, Senate Majority Leader Mitch McConnell spoke to the media, November 9, 2017.

The lowest-income American households would take a hit while higher-earning taxpayers would see their burden reduced under the Senate Republican tax plan, according to the latest analysis from the nonpartisan Congressional Budget Office.

The Senate proposal permanently chops the corporate tax rate and temporarily reduces individual income taxes, while changing numerous deductions. GOP senators hope to pass that plan this week and approve a final bill agreed upon with the House before the end of the year.

The CBO report, released Sunday, estimates that lower-income groups would foot a bigger bill from tax cuts than previously expected.

In 2019, all income groups under $30,000 would have a bigger burden under the bill, the CBO projected. In 2027, that would extend to all income groups under $75,000, as individual tax reductions expire.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates