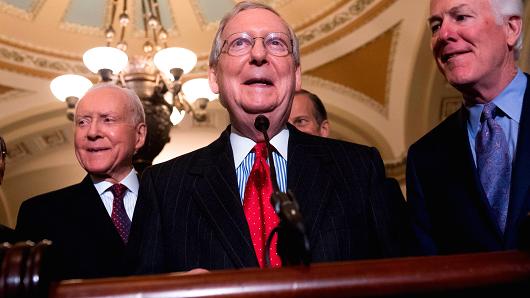

Saul Loeb | AFP | Getty Images

Senate Majority Leader Mitch McConnell (2nd R), alongside US Senator John Barrasso (L), Republican of Wyoming; and US Senator Orrin Hatch (2nd L), Republican of Utah, speaks after a meeting between US President Donald Trump and the Republican Senate Caucus at the US Capitol in Washington, DC, November 28, 2017.

Senate Republicans were confident that they had the votes needed Friday to pass their tax plan as last-minute changes brought more GOP lawmakers on board.

Sens. Steve Daines, R-Mont., and Ron Johnson, R-Wis., earlier Friday said they would back the bill after securing further tax relief for pass-through businesses. Then, Sen. James Lankford, R-Okla., committed to supporting the plan, leaving Republican leaders confident that they had the support.

On Friday morning, Senate Majority Whip John Cornyn, R-Texas, called holdout Sens. Bob Corker, R-Tenn., and Jeff Flake, R-Ariz., the last two senators who need to get on board. The GOP can pass the legislation even if both senators oppose it over budget deficit concerns.

It is unclear where that leaves holdout Sen. Susan Collins, R-Maine, who asked GOP leaders for multiple changes to the bill. Her office did not immediately respond to a request to comment on her stance.

Senate Finance Committee Chairman Orrin Hatch, R-Utah, on Friday said he believes Republicans have the votes to pass the bill. Holdout Corker told NBC News on Friday that he thinks the GOP can approve it even without his vote.

The support Friday from the senators, among the last Senate GOP holdouts, moves Republicans closer to passing the plan. The GOP is reworking their bill after a last-minute setback and hope to pass it later in the day.

The GOP has already secured support from two other key votes: Sens. John McCain, R-Ariz., and Lisa Murkowski, R-Alaska.

Daines reached an agreement with leadership to raise the amount of pass-through income business owners can deduct. The deduction will go to 23 percent from 17.4 percent in the original Senate bill. Pass-through income would still get taxed at individual tax rates, but those business owners would have the deduction. The net effect would drop the rate on pass-through entities below 30 percent, The Wall Street Journal reported.

To offset the cost of those changes, senators are expected to raise the tax rates for businesses repatriating assets.

Pass-through businesses get taxed at individual rates. While those entities include small businesses, most pass-through income goes to the top 1 percent of American earners, according to research cited by The New York Times.

Republican leaders were scrambling to win over Corker and Flake, who are concerned about budget deficits generated by tax cuts. A mechanism designed to win their votes was ruled unworkable under Senate rules on Thursday.

The nonpartisan Joint Committee on Taxation estimated Thursday that the plan would fall $1 trillion short of paying for itself, even after economic growth is taken into account. While GOP Senate leaders like Sen. John Cornyn of Texas and John Thune of South Dakota downplayed the findings, Corker pushed for a way to make up for the budget hole.

Republicans, who hold 52 seats, can only lose two votes and pass the bill if all Democrats and independents oppose it. They only need a simple majority, including a tiebreaking vote from Vice President Mike Pence, under special budget rules.

— CNBC’s Ylan Mui contributed to this report

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates