Sam Edwards | Getty Images

If you’re retired, you’ve probably noticed that costs keep going up.

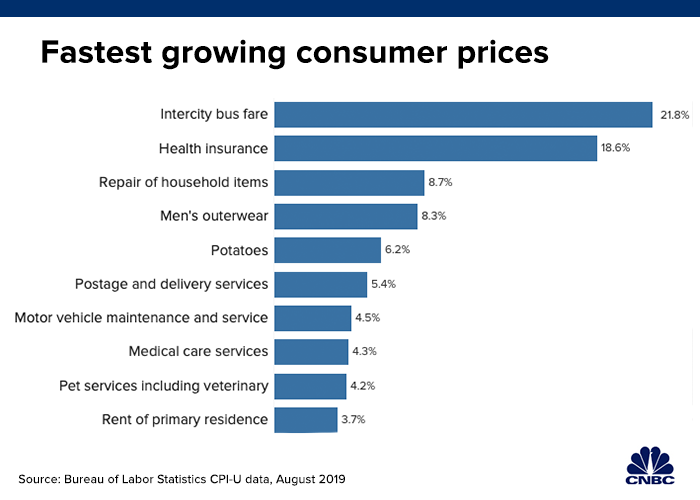

Recent data from the Bureau of Labor Statistics show just which expenses could be taking the biggest bite out of your wallet.

One of the main culprits: health insurance, which surged 18.6% from August 2018 to August 2019. That’s second only to intercity bus fare, which went up 21.8% in the past year.

Other things that have gotten costlier in the past 12 months: repairing household items, which rose by 8.7%; men’s outerwear, 8.3%; and potatoes, 6.2%.

The data come from the Bureau of Labor Statistics’ Consumer Price Index for All Urban Consumers, or CPI-U. The Senior Citizens League, a non-partisan advocacy group, selected the top costs affecting retirees from the data.

But the numbers exclude one big health-care cost for retirees: Medicare premiums. Surveys show that retirees’ total health-care costs are closer to 25% of their overall income, said Mary Johnson, Social Security and Medicare policy analyst at The Senior Citizens League.

How Social Security benefits fall short

Social Security’s annual cost-of-living adjustment, or COLA, uses another measurement to determine how much benefits will increase, if they go up at all. That index is called the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W.

But the CPI-W is not the best measure on which to base those annual benefit increases, The Senior Citizens League argues. That is because that index excludes households that do not have anyone in the labor force — including retirees, Johnson said.

Under that measurement, fast-growing costs like Medicare premiums will not show up in the COLA.

“Spending patterns for health care is particularly important because those costs increase several times faster than overall inflation,” Johnson said. “When it’s not accurately weighted, that means the COLA is not going to keep up.”

By The Senior Citizens League’s calculations, Social Security benefits have lost 33% of their buying power since 2000.

Meanwhile, the Social Security Administration is scheduled to announce the COLA for 2020 later this month.

The League is estimating that increase at 1.6%, based on data available thus far. That’s a cut from last year, which was 2.9%. One reason for the anticipated smaller number: falling inflation.

Another method for calculating COLA

Some argue a better way to determine Social Security adjustments would be to use another index, the Consumer Price Index for the Elderly, or CPI-E.

Unlike other measures, the CPI-E focuses on households with individuals who are ages 62 and up.

But the CPI-E is not an official index. However, there are proposals to change that and make it the key measurement for Social Security’s annual COLA changes.

More from Personal Finance:

Your Social Security checks could get bigger next year

Claiming Social Security based on break-even calculations? Be careful

How Democratic presidential candidates would change Social Security

Those include the Social Security 2100 Act — a bill put forward by Rep. John Larson, D-Conn., that currently has 209 co-sponsors — as well as the Democratic presidential campaign platforms from Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt.

The CPI-E more accurately reflects just how much of seniors’ income goes to housing, health-care costs and other purchases, Johnson said.

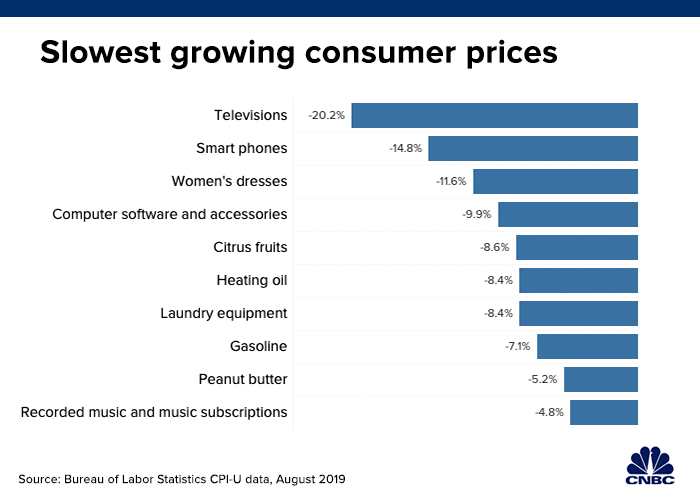

Separately, the latest data from the Bureau of Labor Statistics also show which consumer prices have been the growing the slowest over the past year. Televisions came out on top, at -20.2%, followed by smartphones, -14.8%; and women’s dresses, -11.6%.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates