It could be a September to remember.

Stocks started the month — historically one of the weakest of the year for the market — with a heavy sell-off, fueled by concerns around U.S.-China trade tensions and weaker-than-expected U.S. manufacturing data.

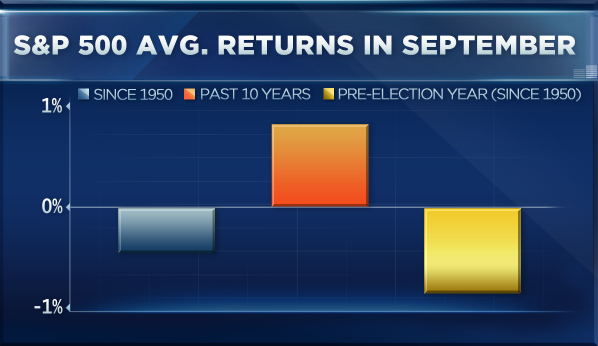

The action, which sunk the major averages by roughly 1% on Tuesday, seemed an appropriate start to September. Not only has it been the worst trading month of the year on average since 1950, it’s the worst month for stock performance in years that precede presidential elections. Stocks reversed course Wednesday as tensions between Hong Kong protesters and China-backed local officials eased.

Despite the not-so-bullish setup, September could shape up to be a better month than many on Wall Street fear, says Ryan Detrick, senior market strategist at investment advisory giant LPL Financial.

“The last 10 years, September’s actually up about 1% on average,” he said Tuesday on CNBC’s “Trading Nation.” “It comes down to kind of what’s priced in and what’s not priced in.”

Detrick sees a lot of “negativity” embedded in the market,including bearish-leaning put-to-call ratios, slumping sentiment polls and daily fear-inducing headlines. And that, he says, is something of a double-edged sword.

“You get any good news with so much fear that’s out there, [and] maybe that little bounce that started at the end of August could have a little bit of life to it,” he said. “This is kind of how these things work. When everything’s priced in [and] we’re all expecting a bad September, maybe we can have a surprise.”

The one piece still missing from the September puzzle is proper market leadership, Detrick said. Only three of the 11 S&P 500 sectors ended the very volatile month of August in the green: real estate, utilities and consumer staples.

“We’d like to see a shift in that leadership,” Detrick said. “As long as you keep seeing those more defensive areas lead, we think this market can kind of continue to be range-bound and … choppy and frustrating. But if you get some more leadership from the more cyclical areas [like financials and technology], that can be a positive. But we might not be there yet. “

What could take us there is the ever-strong U.S. consumer, who could be the key to staving off a 2020 recession, the strategist said.

“Yes, manufacturing’s slow. [The] global economy’s slow. [The] U.S. consumer doesn’t seem to care,” Detrick said. “Retail spending, consumer confidence, those are still there, and 70% of [gross domestic product] is the consumer. So that’s a positive view, and we don’t see a recession [in the] next 12 to 18 months because the U.S. consumer seems to be in such good shape.”

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates