Trader on the floor of the New York Stock Exchange.

Lucas Jackson | Reuters

For the first time since the financial crisis, stocks are earning more for investors than key long-term Treasury notes.

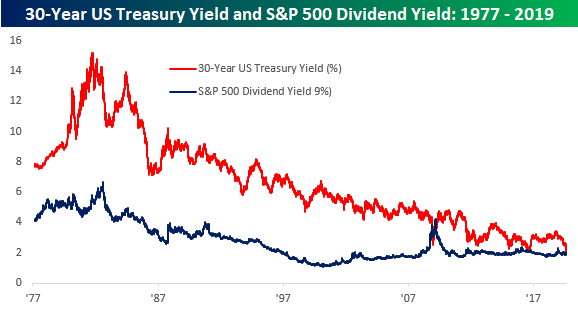

The U.S. 30-year yield dropped below the S&P 500’s dividend yield on Tuesday. It’s the first time since March of 2009 — when the world was deep into a recession — that has happened, according to data from Bespoke Investment Group.

“The outlook is much better for stocks than it is for long-term Treasurys right now,” Bespoke co-founder Paul Hickey told CNBC in a phone interview Tuesday. “For an investor looking to hold something for the long term, it makes equities relatively attractive.”

Investors have poured into safe haven assets like bonds as trade talks have flared up, sending yields to historic low levels. Bond prices move in the opposite direction of yields. The S&P 500, meanwhile, is down more than 4% in the past month as investors drop riskier assets.

While investors may be shunning risk near-term, Hickey said the stock-bond yield inversion is a bullish sign for equities.

“The takeaway is, if you can get an annual yield from a company that’s going to pay you more than the 30-year Treasury and the company has a history of raising its dividend, for the long term, it’s a better alternative than a Treasury,” Hickey said.

Long-term Treasury notes continued a monthlong slide Tuesday. The 30-year bond yielded 1.961%, and was poised to close below the 3-month bill yield for the first time since 2007. This rare phenomenon is called a yield-curve inversion and is widely feared by investors because it has preceded previous recessions. The 3-month Treasury bill rate also traded higher than the 30-year bond yield.

Bespoke examined data going back four decades. Other than the financial crisis, the only other time similar stock-bond inversion come close to happening was in July 2016 — right after the Brexit vote. At the time, the S&P 500 dividend yield came within 0.01% of the 30-year’s yield, according to Bespoke.

Individual stocks now yield more than 5-, 10-, and 30-year US Treasury notes, according to Bespoke’s research. As of Tuesday morning, two-thirds of the stocks in the S&P 500 yield more than the 5-year. More than 60% yield more than the 10-year, and roughly half are yielding more than the 30-year note.

JJ Kinahan, chief market strategist at TD Ameritrade, said this might help support stocks — at least in the near-term.

“Those hungry for yield will continue to buy more ‘safe’ stocks,” Kinahan said. “By this, I particularly mean those stocks in the S&P 500 that offer an attractive dividend but perhaps have less perceived downside risk in a sell off.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates