The way this all would immediately bear on tech investments would be to compress the sector’s valuation. Until last year, the tech bulls were correct that the Nasdaq’s market leadership was supported by stupendous sales-and-earnings growth by FANG and FANG-like companies (Adobe Systems, Nvidia, Apple, Salesforce) rather than speculative froth.

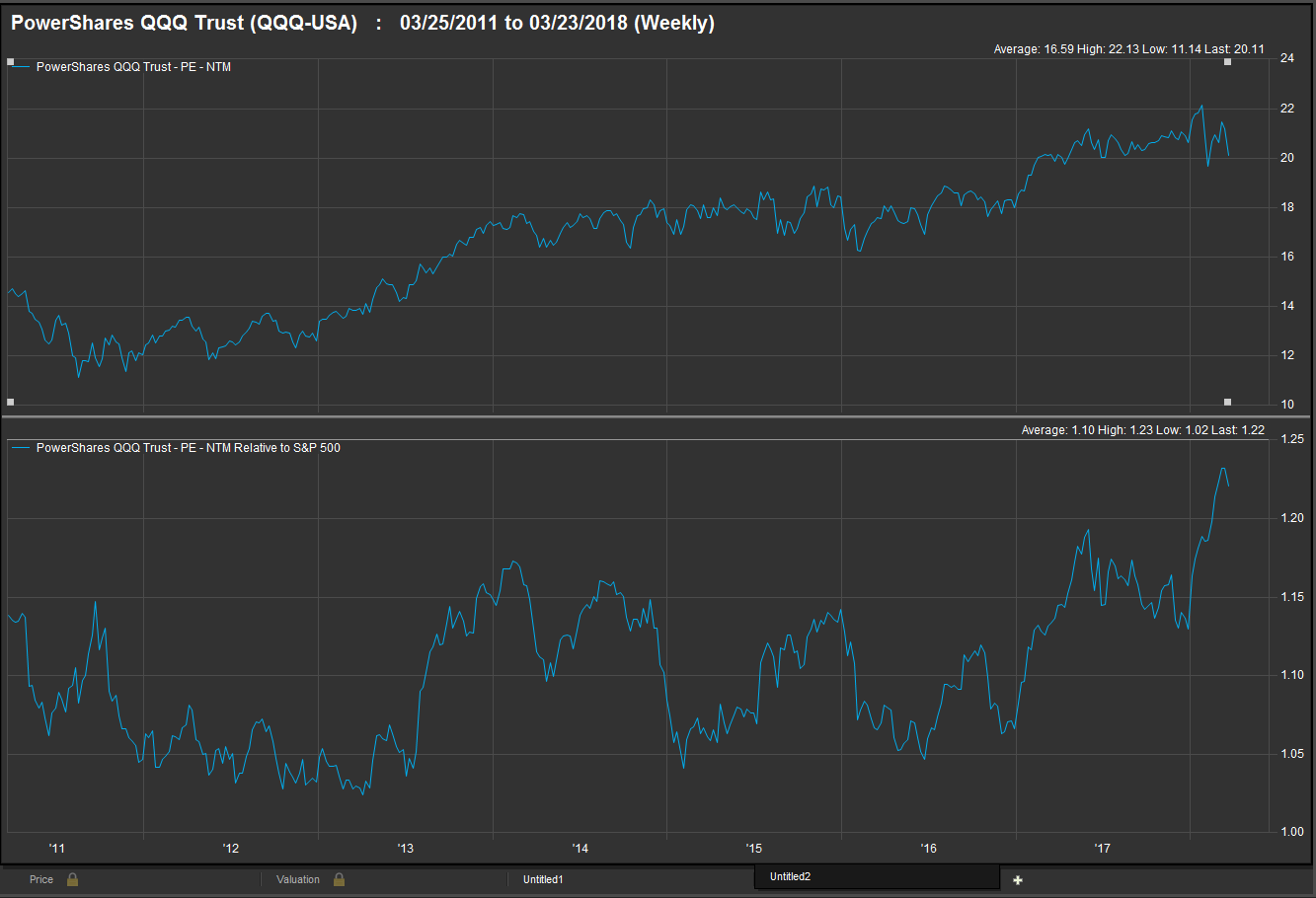

Yet the froth did start to build up in the latter part of 2017:

Source: Factset

The Nasdaq-100 index stretched to a 23 percent premium to the broad market by late January. If this relationship simply returned to its seven-year average premium of 10 percent, it would probably thwart the broad market’s progress for a while.

The upbeat take on the flip side: The S&P 500 excluding tech is as inexpensive as it was around the 2016 election before the market took off — though it’s still a good bit pricier than at the last dramatic market trough in early 2016.

Facebook, no surprise, has gone farthest so far in surrendering its premium P/E. At 21 times projected profits for the next 12 months, the stock’s never been “cheaper” since its April 2012 IPO. As recently as two years ago, its P/E was double the S&P 500’s; now its 1.3-times as high.

Of course, the market is almost surely going to reduce expectations for profit margins over time. Facebook will hire thousands more people to help protect user data and filter ads and content. The business will become far less “virtual.”

Anthony DiClemente, an analyst at Evercore ISI, said last week that ad-tracking services showed no reduction in advertiser interest as the data scandal unfolded. Yes, growth rates were down slightly both for Facebook and search ads on Google from blistering rates of a year ago. But for the moment, the business impact remains more expected than real.

The impact initially could well be more on investor psychology than the bottom lines of tech companies for a while. The case for tech was so pervasive and flexible for a long time. Economy slowing? Buy Big Tech for its sturdy organic growth. Tariffs threatened? The internet giants use no steel and don’t sell much in China anyway. Rates going up? FANG has a massive net cash position and will buy back stock with unlocked overseas earnings.

Now, with tech a quarter of the S&P 500 — and 30 percent when Amazon, Netflix and Booking.com are added from consumer discretionary — it’s more of a two-sided story.

Quantitative strategists at Bank of America Merrill Lynch noted two months ago that actively managed funds were already reducing their tech “overweight” bets — yet it remained the “most crowded” sector. This condition has probably eased further, but the weakness last week contributed to a sense there was “nowhere to hide” from a market sell-off that has already dropped more than 100 S&P 500 stocks at least 20 percent off their high.

Is this a case where a cleansing market correction is never quite complete without the “glamour stocks” being knocked off their perch — so maybe this downturn is running its course? Or are we witnessing the old Wall Street story that bull markets run into serious trouble when the “generals that have led the bulls” charge start to succumb?

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates