Nazanin Tabatabaee | West Asia News Agency | Reuters

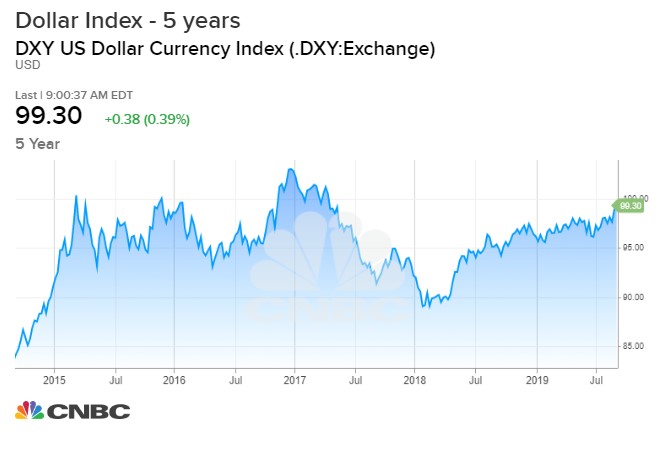

The dollar hit a two-year high on Tuesday as slowing global growth and more aggressive monetary easing overseas sent investors into the reserve currency.

The U.S. Dollar index rose to a high of 99.37, its highest level since May 2017 when the index hit 99.696. The index, which measures the greenback against a basket of other currencies, is teetering near the 100 level, which it hasn’t hit since April 2017.

“Going forward, the dollar will have a hard time declining unless the Fed gets aggressively dovish, simply because global growth remains lackluster and global central banks are easing policy or are about to ease policy,” said Tom Essaye, founder of the Sevens Report.

Although more than $15 trillion of government bonds trading at negative yields around the world, U.S. bonds are still trading in positive territory. Growth is slowing at a much faster rate abroad and global central banks are easing at unprecedented levels. Although the Federal Reserve cut interest rates for the first time since the financial crisis in July, the U.S. economy is strong, compared to the rest of the world. And it’s unclear whether the Fed will keep cutting rates regularly.

A fall in the pound also boosted the dollar. The pound fell close to a three-year low as British lawmakers prepared to vote on the first stage of their plan to block newly elected Prime Minister Boris Johnson from pursuing a no-deal Brexit.

Trump vs. the Dollar

President Donald Trump has been very vocal about his dislike for the stronger dollar.

Trump has ripped on the Federal Reserve on Twitter, blaming the central bank’s “high” interest rate levels, in comparison to other countries, for the dollar’s strength.

Trump has called on Fed chairman Jerome Powell to lower interest rates and even praised ECB president Mario Draghi’s negative interest rates in the euro zone.

The euro plunged to a 28-month low against the dollar on Tuesday as investors priced in deeper negative interest rates from the ECB.

Money markets estimate an 80% probability that the ECB will lower its benchmark rate by 20 basis points when it meets next week.

— CNBC’s Fred Imbert contributed to this report.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates