The index does not suggest that the economy is falling off a cliff. Its reading of 33.5 indicates that data continues to surprise to the upside, but not nearly as much as earlier this year.

While the fourth-quarter GDP reading came in right around expectations, there have been some notable other data misses in February. Domestic auto sales, retail sales excluding autos, multiple housing indicators and durable goods orders all fell short.

A continued downtrend could cause economists to start marking down what have been increasingly aggressive forecasts for full-year growth. Many have come around to the Trump administration’s assertions that the combination of tax cuts and increased domestic spending will push GDP considerably higher this year.

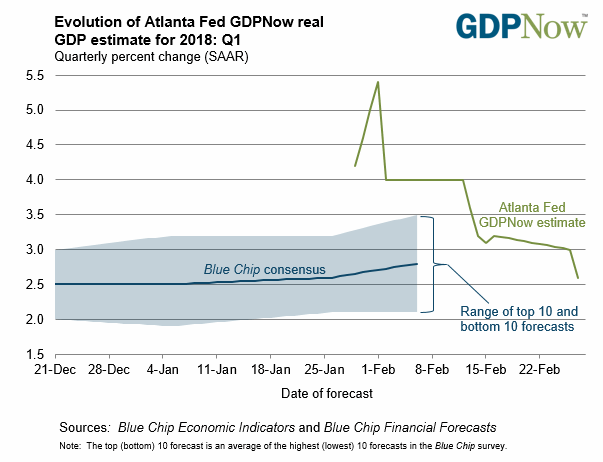

Most recently, though, the Atlanta Fed slashed its projection for first-quarter growth.

The central bank’s widely watched GDPNow tracker drew headlines Feb. 1 when it estimated that the first quarter was moving at a powerful 5.4 percent pace, which would equate to the best quarterly gain since the financial crisis.

However, the string of disappointing reports has caused the Atlanta Fed this week to pull its forecast all the way down to 2.6 percent, following the disappointing durable manufacturing and advanced economic indicators reports.

Even with the cooling economic data, Fed Chairman Powell told Congress in a speech Tuesday that he is optimistic about growth.

“The economic outlook remains strong,” he said in testimony before the House Financial Services committee. “The robust job market should continue to support growth in household incomes and consumer spending, solid economic growth among our trading partners should lead to further gains in U.S. exports, and upbeat business sentiment and strong sales growth will likely continue to boost business investment. Moreover, fiscal policy is becoming more stimulative.”

Powell’s enthusiasm even spooked the market some, with the Dow industrials dropping nearly 300 points after traders worried that the new central bank leader might push for faster rate hikes given his views on growth and inflation soon rising to 2 percent.

Most economists seem to share his views, despite the recent dip in data compared to expectations.

“Looking forward, the outlook remains quite good. Consumer confidence in February reached a 17-year high, even as tight labor market conditions are showing signs of boosting wage growth,” Jim Baird, partner and chief investment officer for Plante Moran Financial Advisors, said in a note. “At the same time, many households are just starting to see the benefit of lower federal taxes in their take-home pay.”

Markets are adjusting their outlook for Fed hikes, with the consensus still forming around three rate increases this year, the first one coming in March.

However, the implied chance for a fourth move jumped Wednesday to a new high of 36 percent from 28 percent a week ago, according to the CME’s FedWatch tracker. There’s now even an 8 percent probability for a fifth hike in December.

WATCH: Debating the market’s response to Powell’s speech.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates