Timothy A. Clary | AFP | Getty Images

President Donald Trump addresses the 73rd session of the General Assembly at the United Nations in New York September 25, 2018.

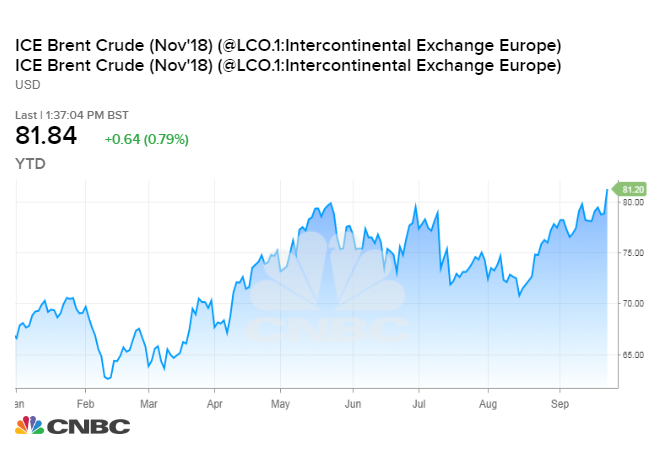

Trump blames that policy for pushing oil futures into a range between about $70 and $80 per barrel and keeping the national average gasoline price anchored near $3 a gallon.

To be sure, the alliance cut output more than anticipated due to production problems in countries like Venezuela and Libya. In June, the group agreed to restore some of that output and return to its goal of keeping 1.8 million barrels a day off the market.

However, Trump’s decision in May to pull out of the 2015 Iran nuclear deal and restore sanctions on that country, OPEC’s third-biggest producer, is also a major factor behind this year’s rally.

The Trump administration has pushed prices higher this summer by telling oil buyers they must cut their purchases of Iranian crude to zero by Nov. 4 or else face U.S. sanctions. The aggressive deadline has left the market to wonder whether top exporter Saudi Arabia and other producers can fill the gap left by the anticipated loss of about 1 million barrels a day in the coming months.

Brent crude prices rose to a nearly four-year high above above $82 a barrel on Tuesday after OPEC and its allies said they would stick to the plan they agreed to in June.

“We want them to stop raising prices,” Trump said Tuesday. “We want them to start lowering prices.”

“We are not going to put up with it, these horrible prices, much longer.”

Saudi Energy Minister Khalid al-Falih told CNBC on Sunday that Trump’s claim on Twitter last week that OPEC is pushing oil prices higher and higher is “not true.” He said the cartel is focused on “more important” aspects of the oil market, like assuring the world is adequately supplied with crude.

Falih said he is concerned about the global economy due to the Trump administration’s trade disputes with several countries and currency pressures in emerging markets. Those factors could dampen demand for oil, making it perilous to increase supply.

“It’s no longer about supply only. I think demand is emerging as a concern as we look at 2019,” he said.

Royal Dutch Shell CEO Ben van Beurden told CNBC this week that $80 oil is not “unreasonable” and may be necessary to fuel spending on oil and gas infrastructure after a period of underinvestment.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates