Threatened U.S. sanctions on Venezuelan oil could further destabilize the beleaguered country, but some economists say there’s already a good chance the Latin American country could collapse on its own.

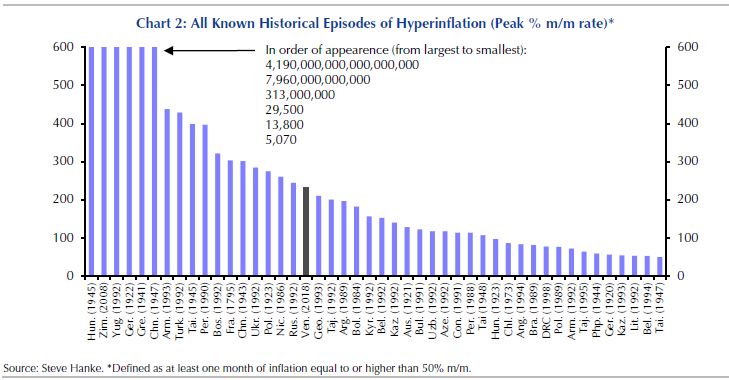

Venezuela’s 14 months of hyperinflation is among the worst in recent history, and that could be its undoing, according to Edward Glossop, Latin American economist at Capital Economics. “It’s difficult for countries to withstand hyperinflation for more than one or two years at the most,” said Glossop, in an interview, noting its inflation rate has been put at over 1 million percent.

Capital Economics studied hyperinflation in 16 other economies, and found that “history suggests that some form of political transition seems likely over the next year or so…First, countries typically do not usually remain in hyperinflation for much longer than two years,” Glossop noted.

The Trump administration this week threw its support behind National Assembly President Juan Guaidó, who declared himself interim president. Thousands of Venezuelans took to the streets in support of the new government, and Vice President Mike Pence vowed U.S. support for Venezuelans and called President Nicolas Maduro, who remains in power, a dictator with no legitimate claim.

If the U.S. were to cut off oil imports from Venezuela, it would do further damage to an already waning industry and push Venezuela’s economy into a deeper crisis.

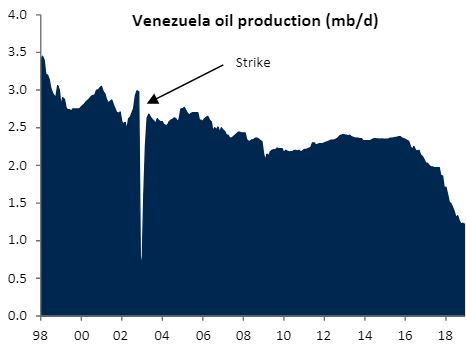

Venezuela has the world’s richest oil reserves, just topping 300 billion barrels, but corruption and a lack of capital have left its one time crown jewel PDVSA a shadow of its former self with deteriorating facilities and an inability to maintain production levels.

Source: RBC

Venezuela’s oil exports are about half of what they were at its peak, and RBC expects a further decline of about 300,000 to 500,000 barrels a day this year, and several hundred thousand more with sanctions.

The U.S. also could cut off the export of diluents, a diluting agent Venezuela needs to thin down its heavy fuel.

As of 2018, the U.S. Gulf Coast refiners were importing some 500,000 barrels a day of Venezuelan heavy crude, about half of the country’s exports, and down from more than 900,000 barrels a day.

At the same time, Venezuela’s GDP has shrunk dramatically and a staggering esimated 3 million of its citizens have migrated, creating a huge loss of economic and brain power. According to Capital Economics, GDP per capita is half of what it was in 2012 and at the same level it was in the 1950s.

While Venezuela has seen hyperinflation for just over a year, it has been in a much longer economic crisis that was exasperated by the sharp drop in oil prices in 2014. Its budget deficit has been in the double digits for the past decade, reaching about a third of GDP last year.

What’s left of Venezuela’s oil industry continues to decline, with the country unable to import the basic capital equipment and materials needed to maintain it, according to Glossop. While it’s unclear what will happen in Venezuela, so far, Maduro appears to be supported by senior military leaders. Glossop said he does not see a long drawn out civil war as a base case.

“Tn terms of prospects for civil war, it would depend on whether you get a big splinter in the military,” he said. “At the moment the army has stuck together…It’s the question of where the country would get the resources to last through a civil war.”

“Hyperinflation should do the work I think. I think the U.S. will watch how things will pan out in the next few months and protests could gather momentum, and things will happen internally,” he said.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates