Insta_photos | Istock | Getty Images

If you’re getting close to retirement age, there are some upcoming changes enacted as part of a government funding bill that may be of interest to you.

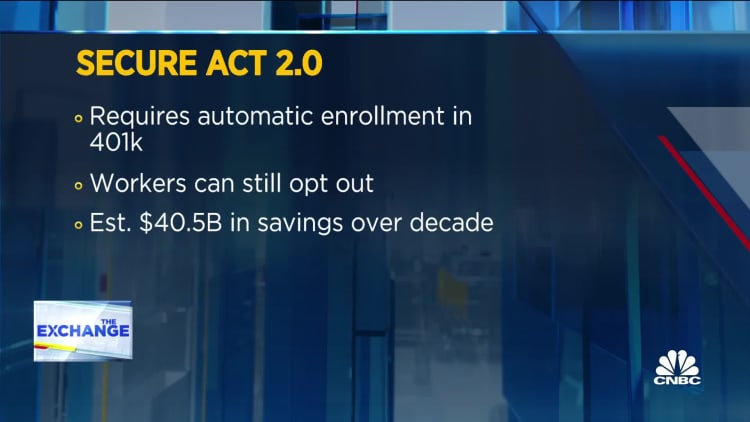

Dozens of retirement-related provisions known as Secure 2.0 were included in an omnibus appropriations package that cleared Congress last week. While the changes collectively are intended to improve outcomes for retirement savers and retirees, a few of them may be particularly useful to near-retirees.

“On the edges, [the changes] do present a lot of retirement-planning opportunities that near-retirees would want to be aware of,” said Joel Dickson, head of advice methodology for Vanguard and a member of its retirement policy group.

Catch-up contributions are poised for changes

Under current law, anyone age 50 or older can make “catch-up” contributions to their 401(k) account. The limit, which changes year to year based on inflation, is $6,500 in 2022 and $7,500 in 2023. Those amounts are in addition to regular 401(k) contribution limits: $20,500 for 2022 and $22,500 for 2023.

Beginning Jan. 1, 2025, individuals ages 60 through 63 will be allowed to make catch-up contributions to their workplace plan of up to $10,000 — or 150% of the regular contribution, whichever is greater — and that amount will be indexed to inflation.

Be aware that if your income exceeds $145,000 (indexed to inflation), all catch-up amounts, regardless of your age, will need to go to a Roth account. Unlike contributions to traditional 401(k) plans, money put in a Roth 401(k) or individual retirement account doesn’t get you a tax break, but qualified withdrawals in retirement are tax-free.

This Roth requirement means “if you don’t have a Roth option in your plan, catch-up contributions wouldn’t be allowed,” Dickson said. “So there would have to be plan changes in those instances to allow it.”

IRA catch-up amount could rise from year to year

Meanwhile, for IRAs, which come with lower contribution limits — $6,000 for 2022 and $6,500 for 2023 — the annual catch-up amount has remained $1,000 since 2006.

Under Secure 2.0, it will be indexed to inflation beginning in 2024, which means it may increase yearly.

“Is it a huge change? No, but it brings it more in line with other [contributions] that are indexed to inflation,” Dickson said.

Matching contributions could go to Roth account

Currently, when employers provide their workers with a “matching” contribution — say, a 100% match up to 5% of income — it must be made to a traditional 401(k) account versus a Roth account. That means those matches are subject to taxation when withdrawn in retirement.

Next year, that will change.

“If their plan allows it, [workers] can elect to have employer matches be designated as Roth contributions,” Dickson said.

Required distribution age will go higher, create possible planning opportunities

Under current law, required minimum distributions — amounts that must be withdrawn annually from certain retirement accounts — begin at age 72.

Secure 2.0 changes that to age 73 in 2023 and then age 75 in 2033. The penalty for failing to take these RMDs will also change, starting next year: In general, it will drop to 25% of the amount that should have been withdrawn, down from the current 50%.

Even if RMDs are far in the future for you, the delay in when they must begin can provide planning opportunities, Dickson said.

“Even though you don’t have to take distributions, some people may find they want to take distributions [early in retirement] or convert some of those assets to Roth as a way to manage their lifetime tax liability and therefore increase the after-tax retirement income they generate.”

Another change: Roth accounts in 401(k) plans and other employer-sponsored plans will be exempt from RMDs starting in 2024. While Roth IRAs come with no RMDs during the owner’s lifetime, that has not been the case for Roth 401(k)s.

Other changes will impact retirement planning as well

Because there are more than 90 provisions in Secure 2.0, there are other changes that could impact your retirement planning. For instance, there are modifications related to annuities and qualified charitable distributions that may factor into how you plan financially for your retirement.

Additionally, if you’ve lost track of a retirement plan you had at a previous employer, be aware that Secure 2.0 directs the Labor Department to create, within two years, a national online, searchable “lost and found” database.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates