The stock market completed a three-day winning streak last Friday, but stocks ran out of steam on the first day of trading this week, even with some encouraging signals on the U.S.-China trade war front.

Don’t blame a deeper dive over the weekend by traders into August’s mediocre nonfarm payroll report for the stall in the markets. In the post-financial crash economic expansion, a slight miss on jobs growth has been more bullish than bearish for stocks.

Nonfarm payrolls increased by 130,000 in August, but that missed Wall Street analysts’ expectations of 150,000 new jobs. Some commentators called it a “Goldilocks Report” — not too hot, not too cold. July and June figures were also revised lower.

Boeing Company hiring managers from various locations gather to interview people during a job recruiting event in Seattle, Washington.

Barry Sweet | Bloomberg | Getty Images

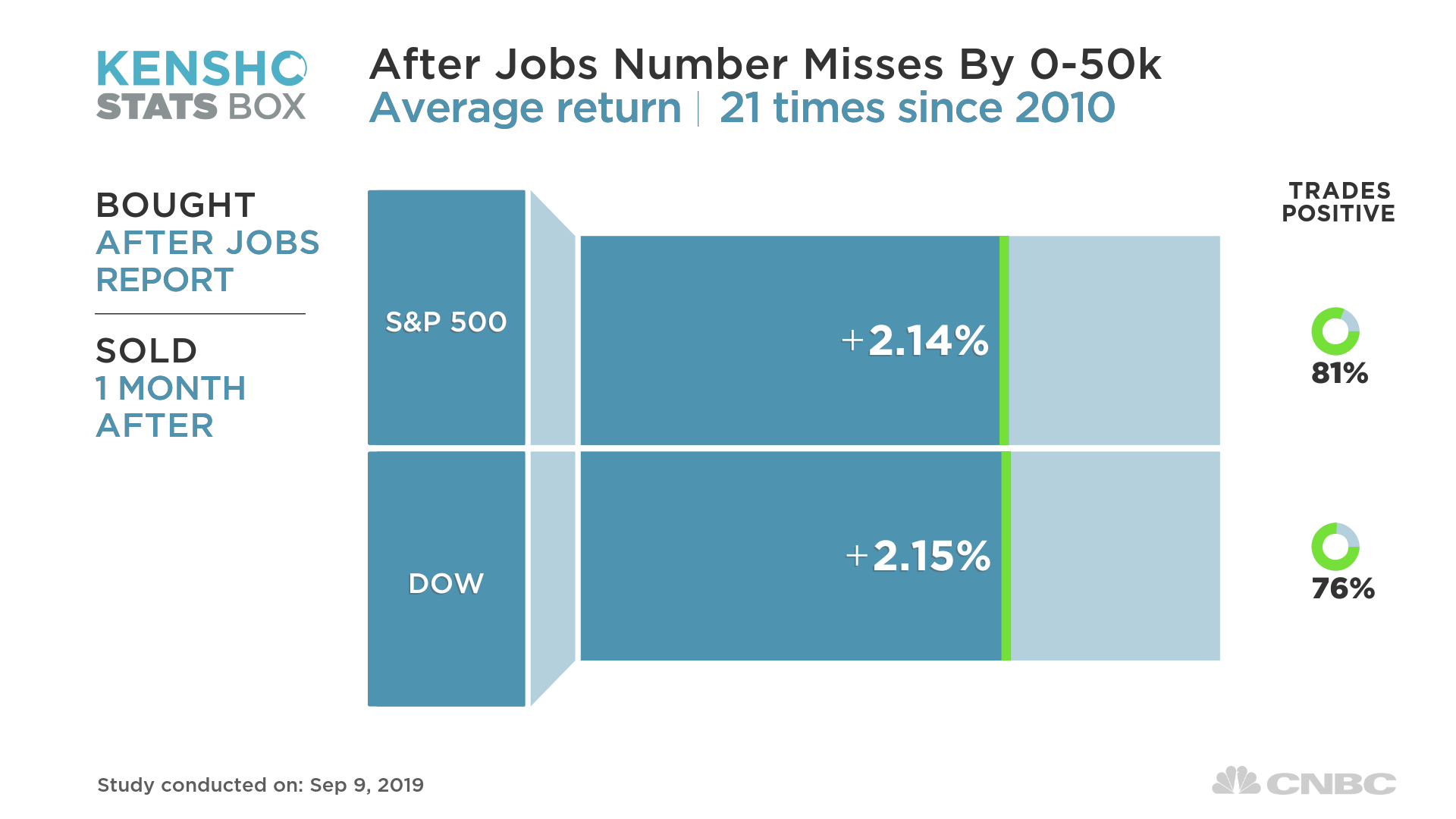

Since 2010, the jobs number has logged a negative surprise of between 0 and 50,000 on 21 other occasions. A month later, the markets have been consistently positive, according to a CNBC analysis of Kensho, a data analytics tool used by Wall Street firms and hedge funds to identify profitable trading opportunities based on history.

The Dow Jones Industrial Average and S&P 500 Index trade higher around 80% of the time in these months, and each index logged an average monthly gain of more than 2%.

As of Monday’s close, the Dow was 2.1% from its record high set in July. The S&P 500 and Nasdaq Composite were 1.6% and 3% below their respective all-time highs.

Trade continues to be the biggest issue for the markets.

“It seems like the tone on trade has gotten better,” Art Hogan, chief market strategist at National Securities, told CNBC on Monday. “That’s the biggest driver.”

‘Fed is locked into cutting’

“If we weren’t already talking about recession risk and already looking for signs of a slowdown, we wouldn’t start today because of this jobs report,” Scott Clemons, chief investment strategist at Brown Brothers Harriman, told CNBC on Friday morning. “On balance, I come down on the optimistic side. I think it’s a pretty good jobs report,” Clemons added.

Paul Ashworth, chief U.S. economist at Capital Economics, told CNBC that aside from the weak headline number, “the rest of the employment report was actually quite positive.”

Wage gains were a bright spot, exceeding expectations, with average hourly earnings increasing by 0.4% for the month and 3.2% over the year; both numbers one-tenth of a percentage point better than expected.

Expectations of above 90% that the Federal Reserve will cut interest rates when it next meets mid-month are also baked into the market.

Fed chair Jerome Powell described the labor market as being in “quite a strong position at an event in Zurich on Friday.

“Maybe it’s a good enough number for [Fed Chair Jerome] Powell to take action. It’s a good enough number to be able to say we’re not going into recession, but let’s not go into recession,” CNBC’s Jim Cramer said on Friday.

“The Fed is locked into cutting in September,” Jason Furman, former Council of Economic Advisors chair, said on Friday. “It would be disruptive and contractionary for them to not do it. I don’t see anything in today’s data that calls for more cuts past September.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates