Tesla is on a tear.

Shares of the electric automaker have climbed a blowout 55% in the last three months, a notable turn for a stock that has struggled this year. As of last week, Tesla was practically flat for 2019 versus the S&P 500’s almost 26% gain.

With Tesla’s Cybertruck announcement creating buzz and, for some, boosting the stock’s bull case, investors may be taking a second look at the name, particularly after Tesla CEO Elon Musk suggested in a tweet Wednesday that the company had received 250,000 orders for the futuristic-looking pickup.

But some investing pros, like Piper Jaffray’s Craig Johnson, feel the stock has run too far, too fast.

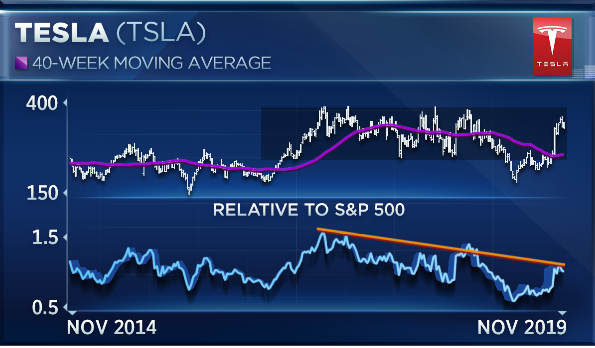

“The stock essentially stuck in a trading range between about 240 and the upper end of the range at 385,” the firm’s senior technical research analyst said Wednesday on CNBC’s “Trading Nation,” citing Tesla’s five-year chart.

Tesla shares closed just below $330 on Friday.

“Having had a huge run up, as you look at the chart, it’s now gotten to be short-term overbought and I’m starting to see momentum slip,” Johnson said. “I’m taking money out of this stock here, waiting for this stock to come back down toward the lower end of that trading range at 290, at minimum.”

Michael Binger, president of independent money management firm Gradient Investments, said he’d also consider taking a position in Tesla under the $300 per share level.

“If the stock pulled below $300 a share, we would certainly be willing to take a look at it,” he said in the same “Trading Nation'” interview. “To me, [the Cybertruck] is more of a sideshow here. Elon’s tweeting about orders, but I’ll tell you, to get an order down you only have to put 100 bucks down, so I don’t put a lot of merit into orders. And we really won’t know if Cybertruck’s going to be a big hit or not until 2022, so it’s a long way off.”

Where Binger found more to praise was across the rest of Tesla’s business, where the company’s fundamentals have been quietly improving.

“What I do like in the story is what’s happening elsewhere in the company. Their total vehicle deliveries is going from about 360,000 this year to 650,000 units two years down the road. Their revenue is forecast to grow 20%-plus for the next several years. They’re actually going to have positive earnings next year, and in 2021, they’re forecast to earn $10 per share,” Binger said.

Add in the potential for Tesla to make $2 billion in free cash flow in 2021, and Binger wasn’t a total bear on the polarizing stock.

“I’ll tell you what: This is a story where I think the rest of the business outside of the Cybertruck is moving forward,” the investor said. “You couldn’t even think about a valuation in the past, and now you can. So, it’s a growth story, it’s outside of the tech and the cloud computing area, so, below 300, I would certainly be willing to take a look at it.”

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates